Pricing can often feel like a game of poker, where I’m just hoping my hands will land me a winning hand without too much bluffing! After navigating the HDB resale market recently, I’ve discovered a few clever strategies that enabled me to secure a favourable deal. Picture me, calculator in one hand and a cup of kopi in the other, working out the complexities of this housing circus. Let’s look into the somewhat amusing world of HDB resale prices, where bargains are possible if you know where to look—and perhaps how to haggle with the heart of a true Singaporean!

Key Takeaways:

- Conduct thorough research on the market trends and prices of HDBs in the area. I once lost hours browsing through property websites, only to discover that I had been distracted by cat videos rather than serious listings! You never know when a hidden gem (or a cat meme) might pop up.

- Timing is everything – The timing of your purchase, similar to catching the bus just before its doors close (or missing it in my case), can significantly impact the price. I experienced this firsthand when I made a hasty purchase following the Golden Week rush, only to discover a month later that the same flat was listed for $20,000 less. Ouch!

- Negotiate like a pro – Channel your inner estate agent and don’t be afraid to haggle. I recall a time when I was so bad at bargaining that I offered to take my coffee to a seller’s meeting. While it didn’t completely seal the deal, I did receive a compliment on my coffee preferences!

- Consider resale value – always think long-term. When scouting for a property, I made the bold decision of choosing proximity to the MRT over a view of the sunset. Trust me, having solid transport links is more valuable than watching the sun dip behind a block of flats. Plus, my morning commute is now dramatically shorter, which means more time for coffee!

- Read the fine print — don’t skip the legal jargon when it comes to paperwork. Once, I overlooked a minor detail in a contract and ended up pledging not only my right to the flat but also my lifelong obsession with pineapple on pizza. Can’t have that, can we?

Understanding HDB Resale Prices

A gentle stroll through the world of HDB resale prices can feel like navigating a maze blindfolded! One moment, you’re buzzing about a lovely four-room flat, and the next, you’re buried under a mountain of numbers and market trends. Fear not, dear reader! Understanding the factors that influence these prices will equip you to secure your dream home without exceeding your budget.

What Determines HDB Prices?

If you think the price of an HDB flat is just a random figure plucked from the sky, think again! Various factors come into play: location, the flat’s age, remaining lease, and even the proximity to amenities like MRT stations. It’s like a game of Deal or No Deal, except the stakes involve your future living situation!

Factors Affecting Your Budget

While setting your budget for an HDB purchase, you must consider several factors that can affect your finances. From the initial down payment to stamp duties and even renovation costs thereafter, it can feel a bit daunting. Here’s a quick checklist to ponder:

- Your down payment percentage

- Stamp duty on the purchase price

- Renovation expenses (don’t forget the “I need to have a walk-in wardrobe” dreams)

Understanding these factors can transform you into a financial expert when making HDB purchases!

A keen eye for unplanned expenses is also essential in this budgetary game. You may think you’ve covered everything, only to find that you neglected to factor in the inevitable costs of moving. You think you’ve added it all up, but your ‘just-in-case’ slush fund has vanished. Pay close attention to the following factors:

- Conveyancing fees

- Home insurance (yes, accidents do happen)

- Any repairs the flat might need after you exchange keys

Recognising these surprise expenses can lead to a more comfortable home-buying experience and prevent you from fainting at your bank balance!

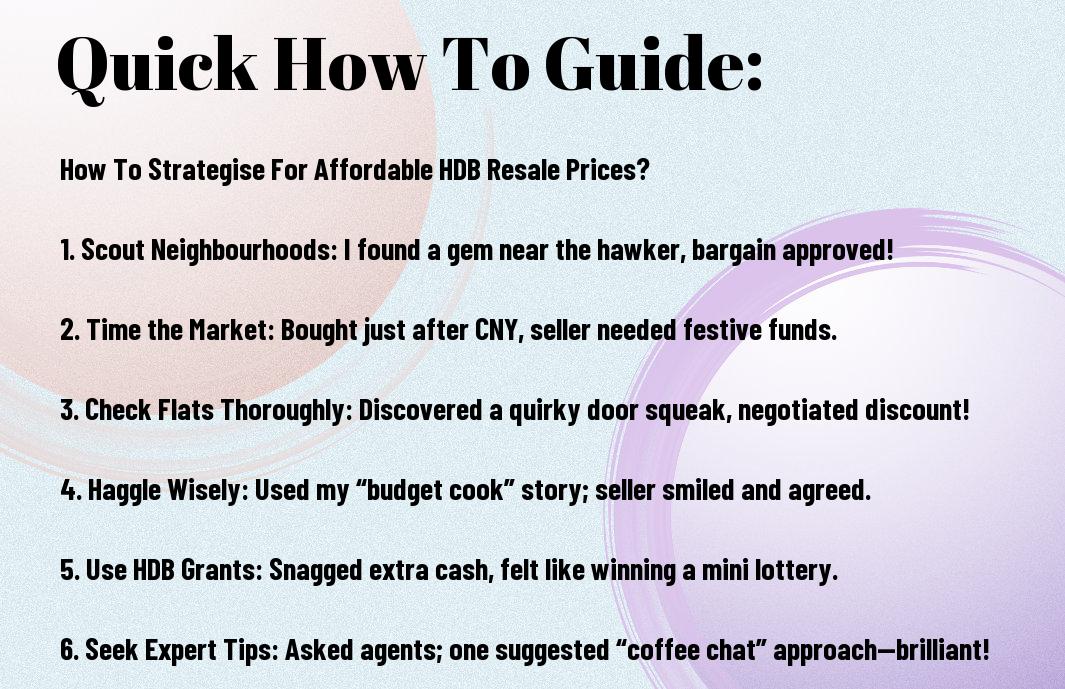

HDB Resale Price: How to Strategize for Affordable HDB Prices

If you’re exploring the HDB resale market, it’s all about strategising effectively. I found that effective planning, from exploring neighbourhoods to engaging with residents over kopi, significantly contributes to uncovering the best deals. Staying informed about price trends and being flexible with your preferences can turn you into a savvy buyer. Who knew scouting for a flat could be as thrilling as a treasure hunt, albeit with slightly less drama?

Budgeting Basics—Finding Your Sweet Spot

If you already have a budget in mind, it’s crucial to identify the ideal balance between your dream flat and your financial constraints. I’ve often found myself doing a budget dance—twirling around must-haves and sashaying past the ‘nice-to-haves’. Be realistic about your limitations, and don’t fall in love with properties that are way over your means, because trust me, the heartbreak is real!

Timing the Market—When to Buy, When to Wait

If you believe that timing is solely about getting the best deal, reconsider your perspective! Getting the timing right in the HDB market can be likened to a chess game. I’ve frequently found myself undecided about whether to make a move or hold off. Are you feeling lucky? Investing during off-peak seasons can result in significant cost savings. But if the market looks too hot, it might just be wise to sit back with a cup of tea and wait for the kettle to boil!

Another thing to consider is the news and economic factors that can affect prices. For instance, I once waited patiently when I heard rumblings of new infrastructure projects nearing completion. My flat eventually came at a sweeter price because more enthusiastic buyers weren’t around yet! Therefore, it’s crucial to remain vigilant, as not only homes in Singapore attract attention!

Tips to Negotiate Resale Prices

Your ability to negotiate can significantly influence HDB resale prices. Here are a few pointers:

- Please ensure you conduct thorough research on recent sales in the area.

- Understand the property’s condition – is it a fixer-upper or move-in ready?

- Be polite and respectful – a smile can go a long way!

- Don’t hesitate to make a fair initial offer.

You might just find a bargain!

Understanding Seller Behaviours

Understanding the motivations of the seller opened my eyes. Some are sentimental, while others are itching to cash out and move on. Once, a seller’s recent sale directly influenced them, giving me an advantage in negotiations. You’d be amazed at how emotions play into their decisions!

Crafting Your Winning Offer

On my journey to my perfect home, I learnt that the offer is more than just a number; it’s a reflection of my understanding of the whole deal. A well-crafted offer considers not only the market value but also the seller’s needs and potential anxieties.

Your offer should be competitive and appealing. I included a personalised note with my offer, explaining my excitement about the house and how I could envision my future there. This personal touch made a significant difference, as it resonated with the seller’s emotional attachment to their beloved abode. Never underestimate the power of a heartfelt note—you never know whose heart you might melt!

HDB Resale Price: What to Look Out For

Unlike a surprise party, hidden costs in HDB resale purchases are definitely not the kind of surprises you want. From stamp duty to legal fees, these pesky extra expenses can quickly accumulate and bite into your budget. It’s crucial to remain vigilant and perform thorough calculations, as it can be disheartening to discover an empty wallet shortly after moving in.

The Price Tag Beyond the Price Tag

What I wasn’t fully prepared for when buying my HDB was the endless list of extra expenses that came along with the actual price tag. The conveyancing process, securing the necessary paperwork, and the home insurance I had to pay for were all significant expenses. Just when I thought I’d budgeted it all, I stumbled upon a whole new realm of financial fun – or should I say torture?

Renovation Realities – When Dreams Meet Budget

Hidden beneath my dreams of a sleek, Instagram-worthy home were the harsh realities of renovation costs. I quickly realised that turning my new space into a personal haven would require more than just a Pinterest board. The cost of adding a coat of paint here and stylish fixtures there quickly added up, turning my “slight” makeover into a feature film budget!

Realising that your grand plans might need to be scaled back can be a sobering realisation. My initial visions of an open-concept living space were replaced by a cosy corner. While I did find some great deals, I also learnt that DIY projects aren’t always the bargains I envisioned. As I stood in the middle of a mess with paint on my face and confusion in my heart, I realised that budgeting for renovations was just as important as budgeting for the flat itself. Therefore, it’s advisable to set aside additional funds for renovations and consider forgoing marble countertops unless you’re extremely wealthy!

Financing Your HDB Purchase

To effectively finance my HDB purchase, I discovered that planning ahead is imperative. I had to juggle my budget, down payment, and future expenses like a circus performer on a unicycle. I recommend shopping around for the best interest rates and maybe even charming your bank manager with your exquisite taste in coffee. This approach will encourage them to offer you a more favourable deal!

Exploring Loan Options—Making Dollars Work

Purchase your dream. HDB doesn’t have to feel like a financial void. I found that comparing different loan options was key. You can choose between HDB loans and bank loans. Personally, I opted for a bank loan because it allowed me to have a little more flexibility. This decision could potentially result in significant interest savings!

Are Grants and Subsidies Really Free Money?

With the thought of grants and subsidies, I often found myself fantasising about free money falling from the sky. Unfortunately, this is not the case. However, there are various grants available for first-time buyers, which can significantly lighten the financial load. Be prepared to delve into the paperwork, as it may appear more like a full-time job than a generous assistance.

Work was my constant companion while I navigated through the realms of grants and subsidies. There was more paperwork than I had anticipated, but the government offers various support schemes that can make a difference. After my unsuccessful attempts to obtain these nuggets of financial aid, I realised that while it may not be ‘free money’, the savings were still substantial. So, embrace the challenge – it could potentially yield significant benefits!

Common Pitfalls and How to Avoid Them

Frequently, I encountered common mistakes in the HDB resale market. One of my biggest mistakes was not doing enough research in the neighbourhood. You might assume that all HDB flats are the same, but I assure you, certain areas present their own distinct challenges, such as the flat next to a 24-hour prata shop. Let’s just say I learnt quickly that late-night roti canai takeaways have a way of affecting your peace and quiet!

Learning from My HDB Adventures

During my exploration of the HDB resale market, I came across numerous unexpected situations. This adventure began with an endless scroll through countless property listings, and I soon realised the importance of setting a clear budget. Instead of allowing my wishlist to become overwhelming, I methodically created a list of essential items. MappingEO: Besides, who needs a rooftop garden when you can save for a lovely pair of shoes instead?

Don’t Do What I Did – Lessons Learned

There’s something whimsical about learning the hard way, isn’t there? As I dived headfirst into property viewings, I found myself getting swept up in the excitement. I made the rookie mistake of overlooking the importance of viewing a flat multiple times—once in the day and once at night! Little did I know that the charming atmosphere during the day morphed into a somewhat eerie vibe after dark, thanks to a rather peculiar neighbour.

From my experience, I have learnt that a lack of thorough inspections can lead to regrettable surprises, like discovering an unexplained musty smell or creaky floorboards! Also, never underestimate the power of asking questions, be it about the flat’s history or the neighbours’ quirks—after all, knowledge is that trusty sword in the battle for a good deal. You’ll want to come out on top, not leave with a hefty repair bill and a bundle of regrets tucked neatly under your arm!

Summing up

Remember, finding affordable HDB resale prices can be challenging, but it’s not impossible! This was a lesson I personally experienced when I ventured into the HDB market. Armed with a set budget and a healthy dose of humour, I embarked on a house-hunting journey, ultimately securing a charming unit with a community garden—after all, who wouldn’t want to share their home with a group of enthusiastic gardeners? Therefore, with thorough research, perseverance, and a healthy dose of humour, you can discover an affordable gem!

FAQ

Q: How can I research the HDB resale market effectively?

A: Researching the HDB resale market can be akin to navigating a buffet where some dishes look enticing but may just be sweetened air. Start with websites like HDB’s official site or property portals like PropertyGuru. They provide tools to sift through the guesswork, showing you historical prices and trends. For instance, I dived into actual resale prices for my dream flat and noticed the prices fluctuated like a teetering toddler. I found a flat listed for S$550,000 but realised it sold for S$490,000 after some savvy footwork. Lesson learnt: always check the ‘sold’ prices, not just the ‘asking’ prices. It’s akin to sifting through a plethora of irrelevant listings to uncover a valuable opportunity!

Q: What strategies should I employ when viewing potential HDB flats?

A: Viewings are like dates; they can be enlightening or just plain awkward. When you attend a viewing, it’s important to apply your analytical skills. Check for signs of wear and tear – that crack in the wall isn’t just a ‘character feature’. Please create a checklist: consider its proximity to amenities, the orientation (to avoid excessive heat), and the flat’s feng shui. Once, I visited a stunning flat that seemed ideal, only to discover that it was situated directly under a flight path. Every time a plane flew over, it sounded like I was auditioning for a rock band! Therefore, remain vigilant during those viewings.

Q: How do I negotiate for a better resale price?

A: Negotiating for a lower resale price is like trying to get a discount on a very stubborn hawker dish – you need charm, confidence, and perhaps a little persistence. Start with market research to back up your price—feel free to mention that lovely flat sold down the road with a lovely alfresco area (which you intend to transform into a meditation zone, of course). During my initial attempt at negotiation, I proposed a price reduction of S$30,000. The seller looked at me like I suggested pineapple on pizza! But after some witty banter and a few rounds of back-and-forth, I found common ground. Be ready to walk away; it’s a powerful tactic!

Q: What are the hidden costs I should know when purchasing an HDB flat?

A: Indeed, hidden costs can be likened to an unexpected guest who consumes all the snacks at the party. Besides the purchase price, you’ll need to consider stamp duty, legal fees, and renovation costs. The renovation bills were a surprise to me when I purchased my flat. The previous owner’s ‘shabby chic’ was my ‘why is this falling apart chic?’ A lovely S$30,000 turned into S$50,000 quicker than I could say, ‘how much for a new kitchen?’ Therefore, it would be wise to allocate a larger budget than anticipated, as those potpourri baskets will require funding. Honestly, you might want to set aside a ‘surprise fund’ for all the delightful surprises that come with homeownership!

Q: Is it better to buy an old HDB flat or a new one?

A: Choosing between an old or new HDB flat is like deciding between a classic vintage car or a brand-new model. There’s charm in an older flat, perhaps some history (and by history, I mean that delightful yellowing wallpaper). While older flats might yield better resale bargains, newer ones often feature modern amenities that can make you feel like royalty. I bought an older flat, and the eclectic layout was delightful—you could play hide and seek behind the numerous columns! One day, I found myself discovering quirky nooks that might as well have been portals to another dimension. Lastly, weigh the pros: older flats can be more affordable, but be ready for extra layers of ‘character’ that may surprise you. It’s a gamble, but when it pays off, it pays off beautifully!