Stocks can be exhilarating at one moment and terrifying at another! I’ve experienced significant fluctuations in Genting Singapore’s shares. I once bought in at what I thought was a bargain, only to see it dip like my enthusiasm when the Wi-Fi goes down. But fear not, dear reader! Let’s explore the most recent insights and unleash a wealth of wit as I recount my experiences in the realm of GSI stocks, proving that investing doesn’t always have to be a daunting task!

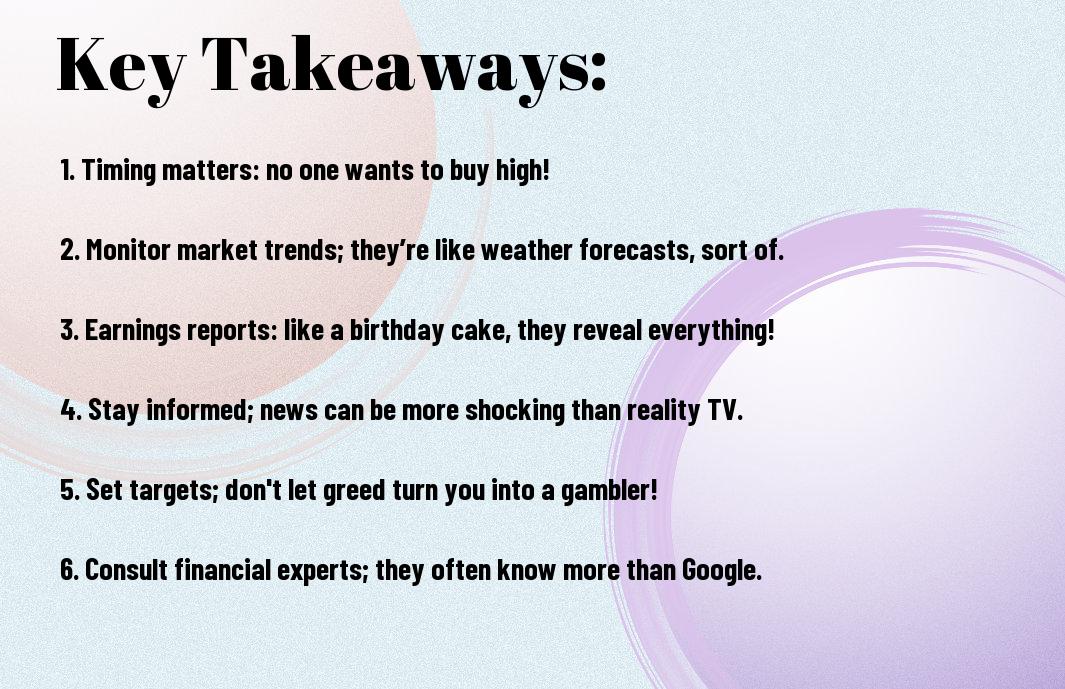

Key Takeaways:

- Genting Singapore’s share price can be influenced by global tourism trends. If you’re thinking of investing, keep an eye on travel restrictions. My last holiday escapade—let’s say my suitcase had more fun than I did—solidified my belief that when travel is booming, so are stocks related to leisure!

- Market sentiment plays a big role. Sometimes it feels like the stock market is a moody teenager—one day it loves Genting, the next it’s sulking and frowning at it. To illustrate, the time I tried to cheer up my teenage niece with a silly dance move led to an embarrassed snigger; invest when the sentiment appears to be positive, but be wary of not looking foolish!

- Earnings reports are vital. Just like my attempts at cooking, they’re either a delightful delight or a total disaster. After leading my family’s taste buds to a melting point last festive season, I’ve realised that after a solid earnings report, GSI’s shares tend to flourish. It’s like a good roast dinner—when done right, everyone’s happy!

- Dividends can add extra appeal. Watching my friends who invest in dividend stocks is almost like observing a hamster wheel at work—effortlessly running but still getting those rewards. The allure of receiving regular dividends from Genting might just keep you in the stock market game longer!

- Be cautious during market dips. Buying when everyone else is fearful can feel like stumbling upon the last chocolate biscuit—a delightful discovery! Last time, I got my hands on a bargain during a dip, and while the shares weren’t as delicious as the biscuit, they did prove to be quite satisfying in the end.

The Spark That Ignited My Interest in Genting Singapore

The moment I stumbled upon Genting Singapore, it was as if a light bulb flickered on above my head. Picture this: I was meandering through the finance section, coffee in hand, when an article caught my eye. It spoke about the potential of this gaming and hospitality giant—and suddenly, I was hooked. My imagination ran wild with visions of illuminated casinos and the buzz of excited tourists. Who knew a bit of reading could ignite such a passion?

A gamble worth taking

Among the many investments I’ve made, Genting Singapore felt like a thrilling casino bet—a gamble worth taking! I could practically envision myself at the roulette table, confidently placing my chips down, hoping for that lucky spin. Sure, it comes with its ups and downs, but isn’t that half the fun? Sometimes, you just have to dive in and enjoy the ride!

The allure of the Singapore skyline

About the dazzling Singapore skyline, I couldn’t help but be captivated. The high-rises, including the iconic Marina Bay Sands, glitter like diamonds against the night sky, showcasing the vibrant life of the city. I often picture myself strolling along the waterfront, soaking in the energetic atmosphere and indulging in some retail therapy. Each time I think of Genting Singapore, I can’t help but imagine the countless tourists flocking to experience the magic of this lively destination.

Singapore offers a unique blend of modernity and tradition, making it a gem in Southeast Asia. The skyline isn’t just a pretty sight; it represents opportunity and progress. With Genting Singapore at its heart, I envision a thriving hub where entertainment and hospitality seamlessly converge, attracting visitors from all corners of the globe. Every glance at that skyline reminds me of the potential this investment holds—quite like spotting a winning number on the betting board!

Understanding Genting Singapore’s Business Model

It’s quite intriguing to probe Genting Singapore’s business model, where the seamless blend of entertainment, hospitality, and gaming creates a perfect storm for fun-seekers and investors alike. You find yourself transported to a land of glitz and glamour, all while the underlying business structure aims for sustained growth and profitability. I mean, who wouldn’t want a slice of that action?

Casino thrills and entertainment spills

The vibrant atmosphere of Genting Singapore’s casinos offers pulse-racing challenges and unforgettable entertainment experiences that appeal to both the average thrill-seeker and the high-rolling high-stakes player. You can’t help but notice the blend of excitement in the air, which makes you think twice before betting your life savings on that single poker hand—unless you’re feeling particularly lucky!

Dining delights – more than just chips and drinks

Between the exhilarating gambles and dazzling shows, you can’t overlook the remarkable dining options at Genting Singapore. It’s truly the hidden gem that elevates your entire experience, allowing you to savour flavours from around the world, all while soaking in that buzz of excitement. Trust me, you won’t just be snacking on chips and guzzling drinks; you’ll be indulging in culinary masterpieces!

Also, if you’ve ever found yourself devouring a piping hot delicacy from a Michelin-starred restaurant whilst quizzically watching a magician baffle onlookers just a few steps away, you realise that Genting Singapore is not merely about gaming. It’s a sensory delight, where every meal feels like a mini celebration in between exhilarating spins on the roulette wheel. So, the next time you’re pondering what to eat, you might just find it’s the perfect cure for the inevitable ups and downs of casino life!

The Rollercoaster Ride of Stock Prices

For most of us who dabble in the stock market, the journey with Genting Singapore shares has been nothing short of a rollercoaster ride. One minute, you’re on a high, sipping a cocktail of confidence, and the next, you’re plummeting down, clutching your heart and mumbling something about market trends. It’s thrilling, terrifying, and utterly exhausting, but at the end of the day, it’s all part of the adventure!

From highs to lows – my emotional journey

When I initially invested in Genting Singapore, I experienced a sense of euphoria and revelled in my perceived wisdom. Then came the moment when my stock took a nosedive, and I found myself questioning my life choices—like, should I have bought that overpriced coffee instead? It was an intense emotional journey that rivalled the intensity of any extravagant soap opera!

Riding the wave with some cringeworthy moments

Ride the wave, they said, it will be fun, they said! However, what they didn’t mention were the cringeworthy moments along the way. Like the time I boasted about my impressive gains to friends, only for the stock to plummet the very next day—oh, the cringe! I was left explaining the intricacies of market fluctuations while internally facepalming.

Understanding the complexities of the market can be a challenging journey filled with unexpected twists. I’ve experienced numerous mishaps, such as trying to time my purchase perfectly, only to witness shares plummet more quickly than my enthusiasm for a dull seminar. It’s moments like these that have me laughing (and cringing) because who knew my emotional investment would rival the financial one? Each wave teaches me valuable lessons, and despite my occasional stumbles, I wouldn’t swap this turbulent journey for anything—perhaps a smooth train ride would suffice on some days!

When to Buy: Timing the Market

All savvy investors know that timing the market is as elusive as finding a needle in a haystack. I’ve had my fair share of missteps, diving in when prices soared, only to watch my investment float away like a dodgy boat in a storm. Patience is key, and often, it’s about waiting for the right moment rather than rushing in at the first glimmer of opportunity.

Playing the waiting game – no FOMO allowed!

About the only thing worse than a bad investment is a hasty one, so I always remind myself that patience pays off. My experience with Genting Singapore taught me to hold off on those impulse purchases. When I resisted that fear of missing out, I found that the market often presented better opportunities, like a magician pulling rabbits from a hat!

Signs it’s time to dive in – or maybe just dip a toe

FOMO is a tricky beast. You see those prices drop and think, “Right, this is my moment!” But hold up! It’s vital to look for signs that indicate it’s genuinely time to buy. I’ve learnt that market dips can sometimes signal a rebound, but it’s wise to conduct a bit of research first—like checking if they’re just seasonal fluctuations or if there’s a legitimate reason behind those pesky price declines.

At times when I’ve seen positive news, such as Genting Singapore expanding its operations or a boost in tourism, I’ve felt more confident to take the plunge. Always keep your ear to the ground; those signs will tell you if it’s wise to dive right in or just leisurely dip your toe to test the waters first! After all, who wants to cannonball into an empty pool?

Analyzing Market Trends and News

To truly grasp the ins and outs of buying Genting Singapore shares, keeping an eagle eye on market trends and news is necessary. I’ve spent many a late night scrolling through stock charts and news articles, wondering whether the latest fluff piece is worth my attention or merely a distraction. I often find myself chuckling at the outlandish claims some analysts make—it’s like watching a soap opera, where one minute they’re on a bull run, and the next, the world is ending!

What the headlines really mean for you

About each headline you encounter, it’s vital to consider what it really signifies for your investments. I’ve found it useful to question whether the latest buzz actually contributes to the bigger picture or if it’s just sensationalism. For instance, when Genting Singapore was in the news for a new expansion plan, I perked up, realising it could be a potential boon for share prices. Be cautious, though—sometimes, the headlines are just smoke and mirrors!

Following the “insider gossip” (with a pinch of salt)

On the subject of insider gossip, it’s necessary to approach it with a healthy dose of scepticism. I’ve often found myself embroiled in conversations over shared tips and speculative whispers—one can easily get swept away by what others are saying. Similar to a friend who confidently claims to have inside knowledge while sipping a pint, I’ve discovered that it’s often easy to mistake conversation for fact.

As I navigated through the realm of “insider gossip”, I came to understand the importance of exercising caution. Take my mate Dave, who once convinced half our circle that Genting was about to make a groundbreaking deal—turns out, he simply overheard a conversation in the pub! His excitement led to a rush of panic selling and then a very sheepish apology when the dust settled. So, while it’s fun to listen to the latest whispers, I always advise doing my own research before making any rash decisions. Otherwise, you might just end up as the punchline of your personal investment journey!

Personal Reflections and Stock Stories

Many people think investing in stocks is akin to playing the lottery—it’s either a hit or a miss! But let me tell you, my journey with Genting Singapore has been nothing short of a rollercoaster ride. I fondly recall the time I researched fervently, pondering whether it was the right moment to jump in. The way stock prices danced around my expectations kept me up all night, almost as spirited as my last attempt at karaoke—talk about highs and lows!

That time I almost sold – but didn’t!

Despite my better judgement, I nearly sold my Genting shares. They were dropping faster than my confidence when attempting to cook a soufflé! As I prepared to press the’sell’ button, a friend’s motivational quote suddenly entered my mind. It was something about resilience and market cycles. So, I sat back, sipped my tea, and decided to hold on for dear life! That moment proved to be a hidden blessing.

The good, the bad, and the utterly ridiculous in stock trading

Against all odds, stock trading brings out a spectrum of experiences, from electrifying highs to gut-wrenching lows, and even cringe-worthy blunders! It’s like being on a reality TV show where every episode is an unpredictable saga of fortune. I’ve found myself laughing (and sometimes crying) at my own misadventures, like when I accidentally bought shares just before I meant to sell! Let’s just say “investor of the year” was not on my résumé that day.

In fact, I’ve had my fair share of absurd moments in stock trading. There was that time I mistook a financial report for an audition script and panicked my way through an earnings call, trying to sound like I knew what I was on about. The good times? Those were when I funnily celebrated the small victories—like a child with a shiny new toy—only to realise later that my “brilliant” timing was purely coincidental. It’s a wild ride, and I wouldn’t trade it for the world—mostly because it’s too entertaining to miss!

To wrap up, figuring out when to buy Genting Singapore shares can feel a bit like trying to predict the weather in Britain—harder than it sounds! I’ve had my moments of sheer excitement when the stock soared, only to find it plummeting like my toast landing butter-side down. So, keep an eye on the trends, enjoy the ride, and don’t take it too seriously; after all, even the best decisions sometimes end with a laugh and a good cup of tea! Happy investing!

FAQ

Q: When is the best time to buy Genting Singapore shares?

A: Ah, the million-dollar question! Essentially, timing the market is like trying to catch a greased pig; it’s slippery and often leads to disappointment. Personally, I’ve found that taking a good look at the seasonal trends is helpful. For instance, if you notice a dip in share prices around the New Year’s festivities when everyone’s recovering from a holiday hangover, it might be a good time to snag more shares at a lower price. Just ensure you don’t buy when you’re also recovering from a hangover—you might forget your investment strategy!

Q: What factors influence the share price of Genting Singapore?

A: Lots of things influence the price—market trends, economic conditions, and even the weather! I once invested during a particularly rainy season in Singapore, thinking, “Oh, damp weather must mean more people indoors at the casino!” Spoiler: It didn’t. But major events, international tourist arrivals, and the performance of their integrated resorts also play parts. Keep an eye on economic news and local tourism stats; they’re like a crystal ball but without the weird fortune-teller vibe.

Q: How can I conduct effective research before buying Genting Singapore shares?

A: Well, you could always don a detective’s hat and go full-on Sherlock Holmes! Dive into financial reports, check industry news, and follow market analyses. I often make it a comedic ritual—watching the news and shouting, “Elementary, my dear Watson!” whenever I spot something noteworthy. You might also want to track social media sentiment around the brand. Just beware: not everyone’s opinion will be as insightful as your Aunt Doris’s after her third gin and tonic!

Q: Is it wise to invest in Genting Singapore during a market downturn?

A: Investing during a downturn can be a bit like going swimming right after a big meal—you might regret it or find it quite refreshing! I once bought in at what seemed like rock-bottom prices, grinning broadly like I’d just found the last piece of cake at a buffet. It felt great until the prices dipped even lower. However, patience pays off, and many have seen a recovery when the market rallies again. Just keep your buoyancy vest handy, as this ride may be bumpy!

Q: What should I do if I panic after buying Genting Singapore shares?

A: First, take a deep breath and maybe count to ten (or twenty, if that suits you better). I once panicked when my stocks plummeted after I bought some; I even contemplated giving all my shares to my cat—she could use the investment opportunities. In reality, it’s wise to look at long-term potential rather than short-term fluctuations. If you’ve done your research, hold tight. Maybe grab a cup of tea, put your feet up, and let time work its magic—just not in the cat’s paws!