Policy issuance often resembles a lengthy process, doesn’t it? But when I opted for Etiqa’s Quick Policy Issuance, it was like finding a magic button that fast-forwards the whole process. Picture this: I thought I was about to look into a sea of paperwork and bureaucracy, but instead, I found myself laughing over a cheeky cup of tea while my policy got sorted out faster than I could say “insurance!” Buckle up; I’m here to share my quirky journey through Etiqa’s speedy service!

If you’ve ever encountered an urgent need for insurance, you may have contemplated the expeditious policy issuance offered by Etiqa. Here’s what to anticipate, based on personal experiences and a few giggles along the way!

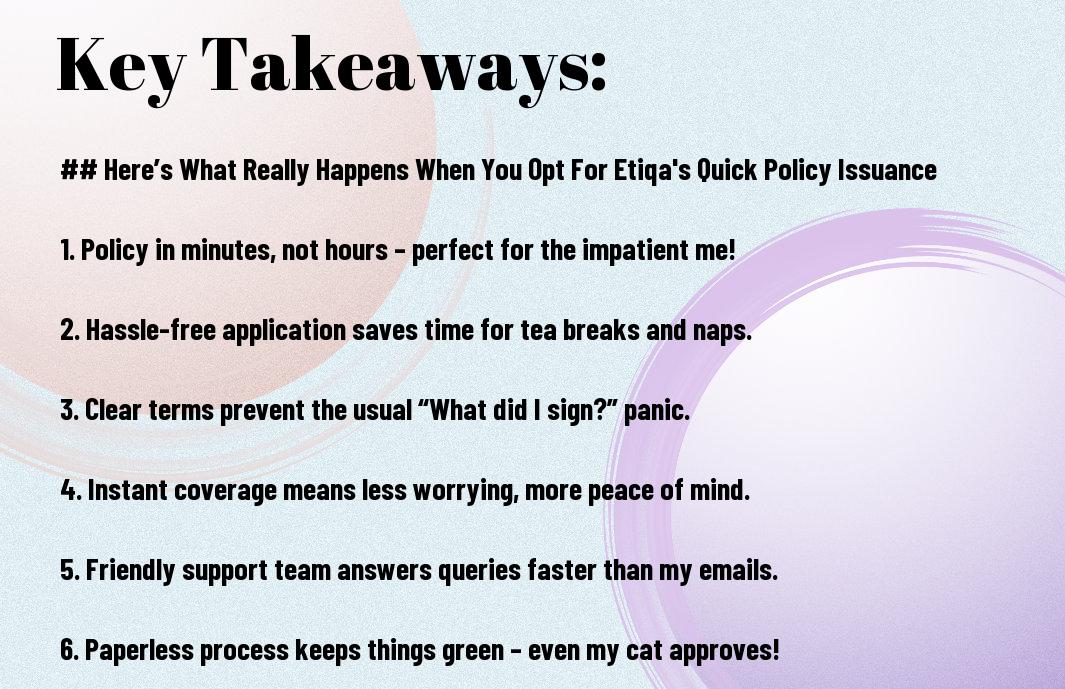

To sum up, Etiqa’s quick policy issuance is not only efficient but also surprisingly pleasant. Who knew getting insurance could turn into an entertaining experience? Just remember to have some cake ready for your celebrations—just in case that rogue cake incident rears its head again!

Here’s What Really Happens When You Opt For Etiqa’s Quick Policy Issuance.

Your journey into the world of insurance can often feel like trying to decipher a particularly tricky Sudoku puzzle. However, Etiqa’s Quick Policy Issuance promises to take the hassle out of securing coverage. It’s like having a cheat sheet; you fill out the imperatives, and bingo, you’ve got yourself a policy in no time!

The Basics of Quick Policy Issuance

Beside all the complicated jargon that often comes with insurance policies, Etiqa’s Quick Policy Issuance makes the whole process a breeze. Basically, it allows you to complete your policy application online in a jiffy, and that’s just the beginning of the simplicity!

How It Works: A Personal Anecdote

Below, let me take you back to the day I decided I needed a bit of protection — life insurance, to be specific. With a few clicks on their website, I was armed with all the details I needed, and before I knew it, my policy was issued faster than I could say, “underinsured.” It felt like being an accomplished magician!

With each click, I could feel the weight lift off my shoulders, and by the end of my little online adventure, I was left chuckling at the ease of it all. I was waiting for a “Ta-da!” moment, but instead, I got a neat little email confirming my new coverage. Who knew insurance could be as delightful as a warm cup of tea on a chilly day?

Here’s What Really Happens When You Opt For Etiqa’s Quick Policy Issuance

Some may think that choosing Quick Policy Issuance is a mere gimmick, but I can assure you it’s like unlocking a secret door to a world where insurance becomes that much easier. Imagine getting your policy sorted in a jiffy while still in your pyjamas and contemplating whether to have breakfast or brunch—what a time to be alive! With Etiqa, I found that not only did I save time, but I also enjoyed a pleasantly hassle-free process. It’s like opting for an express lane in the insurance world!

Speedy Coverage When You Need It Most

Typically, policy issuance is a tedious process, but with Etiqa, it feels effortless. When I needed coverage urgently for a short trip after a last-minute invitation, I was pleasantly surprised by how swiftly I was able to get my policy sorted out. In just a few minutes, my insurance was activated, and I was on my way to a tropical getaway. Who knew insurance could feel like a mini-vacation before the actual one?

Simplified Processes Without the Headaches

Issuance with Etiqa is an absolute game-changer. Gone are the days of endless paperwork and complicated forms that sound like they were written in a whole different language. This simplicity allowed me to focus on what truly matters—enjoying my life and planning my next adventure! My policy processed swiftly and smoothly after I completed the required online forms. It’s insurance that doesn’t require an instruction manual.

This efficiency means that, instead of wrestling with confusing terms and endless questions, I can simply enjoy the peace of mind that comes with knowing I’m covered. With a few taps on my phone, I felt like a wizard casting a spell to erase all the annoying insurance woes of yesteryear. If only everything in life could be as easy as getting insurance with Etiqa!

My Journey Through the Application Process

My journey with Etiqa’s swift policy issuance was not without its challenges. At first, I felt as though I was embarking on a quest, equipped solely with my intellect and a dubious internet connection. Just when I thought I’d outsmarted the system, I stumbled upon more jargon than I could handle, making me wonder if I needed a secret decoder ring!

From Confusion to Clarity: My Experience

Experience taught me that the first few steps were like a labyrinth designed by someone who thoroughly enjoyed a challenging puzzle. I had to grapple with terms I’d never heard of before, wondering if I was filling out a policy form or applying to join the X-Men. Eventually, I managed to piece together the bits of information, and voilà—understanding dawned like a shiny new penny!

Comedic Mishaps Along the Way

As you can imagine, my experience was not without its share of humorous errors! I once got my age wrong while applying—thanks to some hasty typing—and for a brief, glorious moment, I thought I had been accepted as a 75-year-old! Blushing and slightly panicking, I corrected it, only to later find out that my “age reveal” had accidentally suggested I was eligible for the senior discount! Oh, the irony!

But that wasn’t the only mishap. There was also the moment when I submitted my application to the wrong department. Picture this: I was daydreaming and inadvertently sent my details to the dentist instead of Etiqa. Next thing I knew, I was receiving an appointment reminder for a dental check-up! I may have let out an embarrassing laugh when I realised how tangled my application had become. Life certainly has a way of keeping you on your toes!

Real-Life Examples of Quick Policy Impact

Keep a bit of humour handy, because my experiences with Etiqa’s quick policy issuance have left me chuckling more than once. Once, my cat decided to use the curtains as her personal climbing frame, leading to a rather dramatic incident. After experiencing a moment of panic, I quickly arranged my policy and felt prepared to tackle the day. The hassle-free process made a monumental difference when I needed it most.

When Life Throws Curveballs

Any humorous misadventure can be intimidating at times, particularly when it involves your roof leaking during a storm. I had such an event happen once, and while I would usually be scrabbling for a bucket (or four), I had my policy handy and all sorted out. Quick policies from Etiqa meant that help was just a few taps away, and I can’t stress how much of a relief that was!

Quick Fixes That Saved the Day

Quick fixes, I’ve learnt, can literally save the day in the most unexpected ways. I was in the midst of planning a much-anticipated holiday when my car decided it wanted a vacation of its own, breaking down spectacularly. Etiqa’s prompt policy issuance ensured I had a reliable solution to my transportation problems. Life’s hiccups were no match for the efficiency of my policy!

Indeed, when that car of mine broke down, I thought I’d have to cancel my holiday dreams. Instead, I quickly contacted my insurance provider and set up a prompt policy, which led to a multitude of solutions. I had a tow truck on the way faster than I could say, “beach getaway”. That’s the beauty of a quick fix—turning potential disaster into a funny story to tell at all future family gatherings! It’s like having a friend who always has your back, ready to jump in when life gets a bit too real.

The Fine Print: What to Watch Out For

After submerging into Etiqa’s quick policy issuance, the fine print suddenly felt like it was doing a tango in front of me! It’s all witty clauses and sneaky exclusions that you might miss when you’re excited about getting that shiny new policy. So, do keep those peepers wide open! It’s like finding out your favourite ice cream has a sprinkle of broccoli – a tad surprising and not quite what you signed up for.

Navigating the Terms and Conditions

Against all odds, I found myself knee-deep in Etiqa’s terms and conditions, armed with a hot cup of tea and an unwavering desire to understand every fine detail. It was like trying to decode ancient hieroglyphics, but with a bit of patience and a few humorous footnotes, I realised it was all worth it. The more you know about what you’re getting into, the less likely you are to encounter unexpected plot twists down the line.

Common Pitfalls to Avoid (with a Smile!)

Common pitfalls that I encountered on my delightful journey included overlooking imperative deadlines and assuming everything mentioned was black and white. However, life is rarely that straightforward, particularly when dealing with insurance jargon! There’s a vast difference between ‘as soon as possible’ and ‘whenever I feel like it’. Setting reminders has become my new best friend to avoid any unwelcome surprises!

In addition to deadlines, using specific terms when contacting customer service can save you a lot of back and forth (or, as I like to call it, the “email marathon”). Furthermore, be careful about those coverage limits; it’s like ordering a fancy coffee and only getting a thimbleful of it. So, navigate these potential traps with a playful eye; it’ll make the journey much more enjoyable!

The Etiqa Customer Service Experience

I can attest to the expertise of Etiqa’s customer service team. I once had an issue with my policy details, and within minutes of calling, I was speaking to a cheerful representative who sorted out my concerns and made me chuckle with their witty responses. They don’t just answer queries; they make you feel like part of the family. I walked away feeling entertained and informed – not an easy feat when discussing insurance!

Help When You Need It (and When You Don’t)

At Etiqa, a dedicated team stands behind every exceptional customer service experience, prepared to take immediate action, even when your question appears as insignificant as asking a goldfish about its weight. It seems they have an endless supply of patience and humour, which is quite refreshing. So, whether your concern is pressing or just a random musing about what would happen if your parrot accidentally ate your policy document, they’re there to assist!

My Hilarious Customer Service Encounter

When I found myself accidentally locking myself out of my Etiqa account (don’t ask how; I’d rather not relive that moment), I decided it was time to get help. I called their customer service and explained my woeful predicament with a hint of embarrassment. The representative responded with a light-hearted quip about how I must be “quite the lock expert”, which had me laughing and eased my nerves instantly.

Hence, the whole experience turned out to be not just an issue resolution but also an unexpected comedy show. I couldn’t help but share the tale with friends, embellishing it just a smidge for effect (let’s say I dramatically fell through the front door in my haste!). So, if you ever need assistance from Etiqa, brace yourself; you might just end up with a story worth telling over drinks! Who knew insurance could be this entertaining?

Summing up

Ultimately, opting for Etiqa’s quick policy issuance felt like ordering a coffee in a café and getting a free pastry as a bonus! After pressing a few buttons, I quickly obtained coverage, chuckling at the unexpected speed of the process. Just imagine me sitting there, waiting for a traditional policy, and suddenly receiving my documents faster than my last online shopping spree. It’s a delightful experience that seamlessly balances efficiency with a playful chuckle. Try it; you might just find it as amusing as I did!

Here’s What Really Happens When You Opt For Etiqa’s Quick Policy Issuance.

Q: What is Etiqa’s Quick Policy Issuance process like?

A: Ah, the Quick Policy Issuance at Etiqa! It’s like ordering fast food, but instead of a burger, you get insurance. Instead of waiting endlessly for your policy approval, you can choose a swift and efficient process. I recall my mate, Dave, who decided one day he wanted insurance so quickly he could almost taste it. He whipped out his phone, filled in some details, and before he could finish his last slice of pizza, he got a notification — his policy was ready! In his excitement, he nearly choked on the cheese. So, get ready for a thrilling ride through the world of insurance without the usual wait!

Q: How does the online application for a policy work?

A: Picture this: you’re lounging on your couch in your pyjamas, because why not? It’s Sunday! You hop onto Etiqa’s website, and voilà — the application process is as straightforward as assembling flat-pack furniture without the missing screws. You fill in your details, answer a few questions, and boom! You’ve unlocked the secret world of insurance. My sister once did it while half-watching a romcom, and let’s just say that if her love life was as quick, she’d be married by now! It’s a breeze, folks!

Q: Are there any pitfalls one should look out for?

A: Well, as with anything that promises a quick fix, there are a few sneaky pitfalls. For instance, when my neighbour carved out time during his five-minute “tea break” to get insurance, he ended up leaving out a few important details. Although his policy was approved, it did not include coverage for his beloved pet parrot, Mr Fluffy, which he discovered to his dismay when Mr Fluffy decided to blow up his garden! So, while it’s a speedy process, make sure you double-check everything, or you might end up with a policy that leaves you wishing you hadn’t raced through it.

Q: What benefits can you expect from a quick policy issuance?

A: The benefits are as delightful as a fresh scone with clotted cream! Firstly, you receive peace of mind more quickly than you can prepare a cup of tea. You’ll find your policy documents in your inbox faster than some of my friends can finish a crossword! When I opted for Etiqa’s speedy service, I was pleasantly surprised to find my policy details arrived before I could even process the last episode of my Netflix binge. It’s excellent for those who don’t want life’s uncertainties hanging over their heads like a rain cloud on a picnic day!

Q: What happens once you’ve got your policy?

A: Once you’ve secured that shiny new policy, it’s like getting a golden ticket to an insurance wonderland! You’re all set to enjoy the coverage you chose. It’s important to understand the ins and outs, which provides you with security. When I got mine, I felt like I was in an action movie, knowing I wasn’t just another character waiting for a plot twist. Rather than worrying about whether I had left the oven on, I could relish the tranquilly of my mind. Just don’t forget to keep your policy handy, or you might just be one forgotten document away from a comedy of errors!