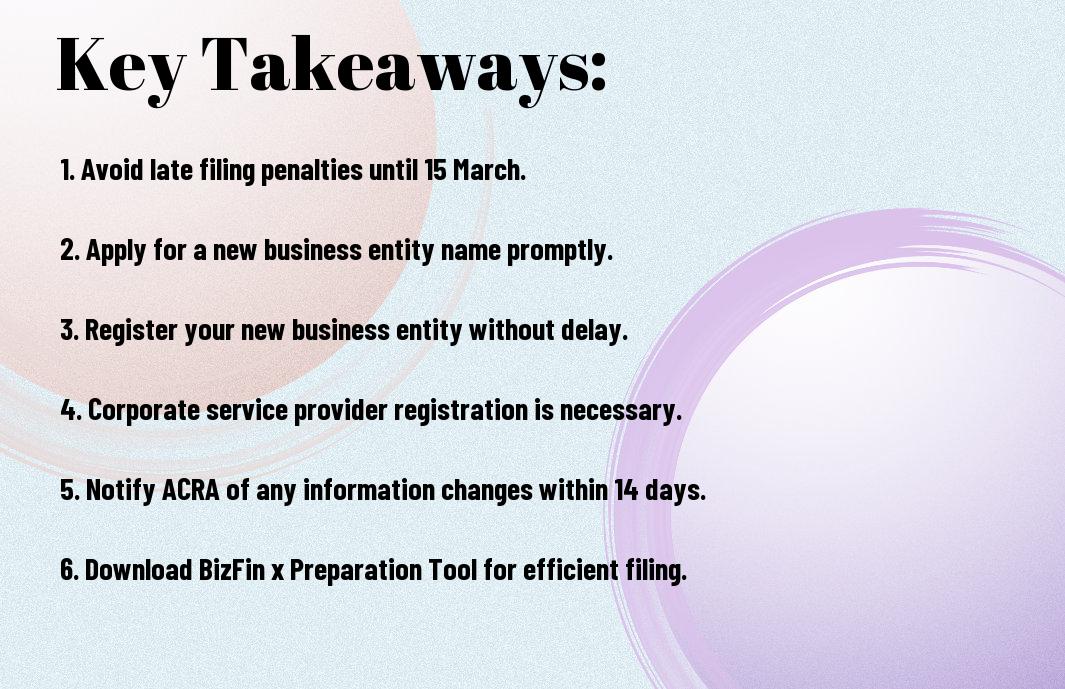

Over the years, I’ve seen far too many entrepreneurs fall into pitfalls with ACRA BizFile that could’ve easily been avoided. With a grace period for late filings until 15 March, it’s the perfect opportunity to chat about some common blunders to steer clear of. Whether you’re applying for a new business entity name or registering as a corporate service provider, I’ll guide you through the must-do steps to keep you sailing smoothly and above water in regulatory requirements.

Common ACRA BizFile Pitfalls

As someone navigating the labyrinthine world of ACRA BizFile, I can assure you, avoiding common pitfalls is vital if you wish to enjoy a smooth business experience. It’s all too easy to trip over a minor detail and suddenly find yourself staring down the barrel of a hefty fine, or worse, with your valuable business benefits at risk. Whether it’s failing to maintain your business details or letting paperwork slip through the cracks, these missteps can turn into monumental headaches faster than you can say “administrative chaos!”

Late Filing Penalties: The 15 March Grace Period

BizFile offers a rather generous grace period until 15 March for late filings, which gives you a little leeway to sort out your business’s paperwork without panicking. However, don’t be fooled into thinking that it’s a free pass! While you might be saved from penalties for now, it’s worth pondering the chaos that can ensue if you delay filing important documents. It’s like celebrating your birthday a little too boldly and then having to deal with the aftermath—your business deserves better than that!

The 14-Day Notification Rule for Business Changes

Before I get into the nitty-gritty, let’s be clear: if your business goes through any change, like a new address or a shift in activities, it’s my duty to inform you that you have a mere 14 days to notify ACRA. Yes, you heard it! Don’t let any of those sneaky updates pass you by, or you might find yourself swimming in penalties or receiving unwelcome attention from the bureaucrats. Keeping ACRA in the loop is as important as your morning coffee rituals!

March may spring forth with bouquets and butterflies, but let’s not forget about the 14-day notification rule. If you change your business’s address or activities, consider it to be a fresh bouquet that must be promptly delivered to ACRA’s doorstep, lest it wilt away and cause you stress. Staying on top of this may appear tedious, but ensuring that your details are up-to-date will save you from potential pitfalls and keep the ACRA watchdogs off your back.

Essential Registration Processes

Even the most experienced entrepreneur may underestimate the significance of registering their business, which can result in various issues later on. It’s akin to attempting to bake a cake without verifying the necessary ingredients—a surefire path to disaster! The good news is that navigating the registration maze doesn’t have to make your head spin. With a little patience and attention, you can set your new venture on the right path.

Applying for a New Business Entity Name

Around the world of business registration, your entity name is your first impression, and you’d want it to be a good one. It’s not just about picking something catchy; it has to stand out and align with your brand. Furthermore, you don’t want to unintentionally choose a name that already exists! Ensuring your name is unique makes your business memorable and keeps you out of any potential legal squabbles.

Registering Your New Business Entity

Registering your new business entity is akin to completing a puzzle. It’s where everything comes together, and the moment you hit that submit button, your idea officially gets a place in the world. But it’s not just a dawdle in the park, so prepare to gather all the required documents and information necessary for the registration process! Each bit of information must be accurate, so double-checking your forms is a must—because no one wants a typo at such a crucial stage.

Organizing your affairs in advance can actually prevent numerous issues later on. It’s all about making sure your business name is not only dazzling but also compliant with ACRA’s regulations. This way, when you hit that magical ‘register’ button, you can do so with the confidence that your new endeavour is built on a solid foundation. Who wouldn’t want to embark on their business journey with a fresh start and no unresolved concerns?

Corporate Service Provider Registration

Once again, let’s investigate the fabulous world of corporate service provider registration. You might think the idea sounds as thrilling as watching paint dry, but fear not! I’m here to guide you through the process and help you avoid any slip-ups that could lead to unnecessary penalties or frustrations. After all, there’s nothing worse than falling foul of the rules when all you want is to help others get their businesses off the ground. So, let’s make sure you’re fully equipped for this registration journey!

Requirements and Qualifications

Before you start dreaming about the day you can don your official corporate service provider hat, let’s chat about the requirements and qualifications you need to tick off your list. First, I need to ensure that you have a registered business entity in Singapore; otherwise, you’re about as qualified as a cat trying to catch a laser pointer. Secondly, you must possess relevant experience in providing corporate services, as you’d be handling the nitty-gritty bits of other companies’ registrations, compliance matters, and myriad other responsibilities. Additionally, ACRA will be looking for evidence of your completion of specific training or qualifications related to this industry—consider it an opportunity to earn your credentials!

Application Process and Timeline

Qualifications aside, let’s talk about the application process and timeline. It can be challenging to navigate through the maze of paperwork, but with patience and perseverance, you can successfully complete the process. The first step is to prepare and gather any necessary documents to support your application. ACRA loves all those little details, like proof of your qualifications and a solid compliance plan. Once everything’s submitted, in à la mode fashion, you’ll typically receive feedback within a few weeks. However, if you manage your time effectively and ensure everything is in order, the process may proceed more quickly!

While the timeline may vary, it is generally recommended to allocate a minimum of four to six weeks for the entire process to progress. So, it’s a good idea to plan ahead and not leave things until the last minute, as you wouldn’t want to be twiddling your thumbs waiting for approval when you could be getting back to business! Filing your application early also has the bonus of giving you some buffer room for any additional information ACRA might ask for. Keep your eyes on the prize, and you’ll be registering as a corporate service provider before you know it!

BizFin x Preparation Tool

Now, if you’re wondering how to get hold of the BizFin x Preparation Tool, it’s as easy as pie! Just hop over to the BizFile website and look for the download link. You’ll receive a ZIP file, which you’ll need to unzip (I promise it’s not as scary as it sounds). By downloading it, you consent to the terms and conditions outlined by ACRA, a minor investment that guarantees the smooth operation of your business filings. It’s a small click that’ll save you a lot of headaches down the road!

Download Instructions and Agreement Terms

Across the internet, there are many downloads, but this one is a gem for any entrepreneur looking to sidestep a mountain of paperwork. Simply click on the link provided, and in mere seconds, you’ll have the tool at your fingertips. Just make sure to peruse the terms and conditions—although I realise they are not the most thrilling read, it’s always valuable to know what you’re signing up for!

Benefits of Using the Preparation Tool

Tool around with the BizFin x Preparation Tool and you’ll quickly discover just how handy it can be! It simplifies the preparation of your documents necessary for filing, making what once felt like a mountainous task much more manageable. You’ll find that your submissions are more accurate and complete, significantly reducing the likelihood of rejection or delays—both things that no business owner wants to experience.

In fact, this nifty little tool not only saves you time but also helps you stay compliant with ACRA’s ever-changing regulations. It’s like having a trustworthy sidekick guide you through the labyrinth of business decisions. So, embrace it and watch how it effortlessly enhances your filing experience, making it smoother and far less stressful. Your future self will thank you for it!

Information Management Best Practices

Not keeping your business records up to date is like trying to put together a jigsaw puzzle without the corner pieces; it just doesn’t work! I know it can be a bit tedious, but maintaining good information management practices is vital for the smooth running of your business. You wouldn’t want to be caught out by ACRA for not having your ducks in a row, would you? An easy way to avoid such pitfalls is by systematically reviewing your records, ensuring all information is accurate, current, and in line with your business activities.

Keeping Business Records Current

With the hectic nature of running a business, it can be effortless to overlook important updates. But take it from me: letting your business records gather dust is a surefire way to invite a whole world of trouble. I recommend setting regular reminders in your calendar to review and update your business information—perhaps once every quarter. Trust me, a little proactive maintenance can save you a lot of stress down the line!

Address and Activity Change Protocols

To keep ACRA from resembling a spooky ghost hovering over you with late filing penalties, it’s vital to notify them of any changes to your business address or activities. If, for instance, you’re moving to a SWISH new office or diversifying into new ventures, make sure to update ACRA within 14 days! The update is your opportunity to present your business accurately and confidently to potential partners and clients. Think of it as keeping your business wardrobe freshly ironed and stylish!

And don’t wait until you’re all packed up or knee-deep in new projects before you think about notifying ACRA. You’ll want to ensure that the paperwork matches your current operating status, avoiding any mix-ups that could lead to headaches later on. Just keep it simple—communicate changes promptly, and you’ll feel much more relaxed as you juggle all the exciting things that come with running your business!

Avoiding Compliance Issues

Keep your business running smoothly by steering clear of compliance issues with ACRA. It’s all about staying informed and on top of your obligations. I can’t stress enough how vital it is to keep your details up-to-date. If your business address or activities change, you’ve got a mere 14 days to notify ACRA. Who wants to be the one caught unprepared? Not me, and I certainly hope not you either!

Setting Up Reminders for Important Deadlines

Every successful business owner possesses a wealth of reminders for crucial deadlines. If you’re anything like me, a trusty calendar is your best friend. I find it’s quite the lifesaver—just pop in those important dates and you’ll be less likely to let a vital deadline slip through the cracks. Set up reminders well in advance, so you have enough time to gather your documents and file everything properly. You’ll thank yourself later when you’re not scrambling at the last minute!

Document Verification Procedures

Procedures for document verification are often overlooked, but trust me, you don’t want to fall into that trap. Please make sure all your documents are in order and comply with ACRA’s requirements before filing. I always double-check that my documents align with what ACRA expects—no one wants to be the reason for delays. Plus, a bit of diligence now saves you heaps of hassle later. So, take the time to verify your information; it’s one of those small steps that can make all the difference!

You should be acutely aware of the importance of document verification. If you think you’re just going to throw everything together and hope for the best, think again! I always keep a checklist handy to avoid any last-minute faux pas. From ensuring that my business information is accurate to confirming that the right signatures are in place, these checks can prevent headaches down the line. Putting in a little upfront effort can significantly reduce compliance issues!

Final Words

Summing up, navigating the ACRA BizFile landscape doesn’t have to feel like deciphering ancient hieroglyphics. Avoiding those pesky late filing penalties until 15 March is a golden opportunity that you simply can’t afford to miss. Make sure you get your business entity name registered, and whilst you’re at it, take a moment to register your new business entity as well. I find that planning and preparation really saves me a boatload of stress down the line. We kindly suggest downloading the BizFin x Preparation Tool. It’s as easy as pie, and you’ll be thanking yourself in the long run.

Furthermore, keeping your details up to date with ACRA is like keeping your wardrobe current; it just makes everything look smarter! If there are any changes to your business address or activities, please ensure that ACRA is notified within 14 days. Trust me, staying proactive about these things will definitely save you from unnecessary headaches. So, let’s stop making those common BizFile mistakes and put ourselves on the path to smooth sailing in the world of business registrations!

FAQ

Q: What are the common mistakes to avoid when filing with ACRA BizFile?

A: Common mistakes include failing to file annual returns on time, providing incorrect business information, neglecting to update changes in registered details, submitting incomplete applications for new business entities, and overlooking the requirement to notify ACRA of changes within 14 days. These errors can lead to delays or penalties.

Q: Are there penalties for late filing with ACRA before 15 March?

A: No, there are currently no late filing penalties until 15 March for submissions. However, it is recommended to file on time to ensure your business remains in good standing and to avoid any potential issues in the future.

Q: How do I apply for a new business entity name?

A: To apply for a new business entity name, you need to log in to the BizFile portal and complete the application form for name approval. Ensure that the proposed name adheres to ACRA’s naming guidelines and is not already in use by another entity.

Q: What steps are involved in registering a new business entity?

A: To register a new business entity, you must prepare the necessary documents, including the details of the business structure (such as a sole proprietorship or partnership), company name, business activity, and details of the owners or shareholders. After gathering these documents, you can submit your application through the BizFile portal.

Q: How do I register as a corporate service provider?

A: To register as a corporate service provider, you must comply with regulations set forth by ACRA. The process typically involves submitting relevant details about your business and its activities, ensuring you meet licensing requirements, and completing the necessary application on the BizFile portal. Please make sure you have all the necessary documentation and information prepared for submission.