It’s not every day you find yourself chasing shares, but when I came across Nanofilm Technologies International Limited, let’s just say my excitement rivalled that of a kid in a sweet shop! With a rollercoaster of ups and downs, I’ve stumbled upon some cheeky tips and true tales from my investing escapades—think of it as a comedy show meets financial advice! Gather your calculator and prepare to laugh as we explore my insights on the Nanofilm share price and the strategies for navigating this dynamic market!

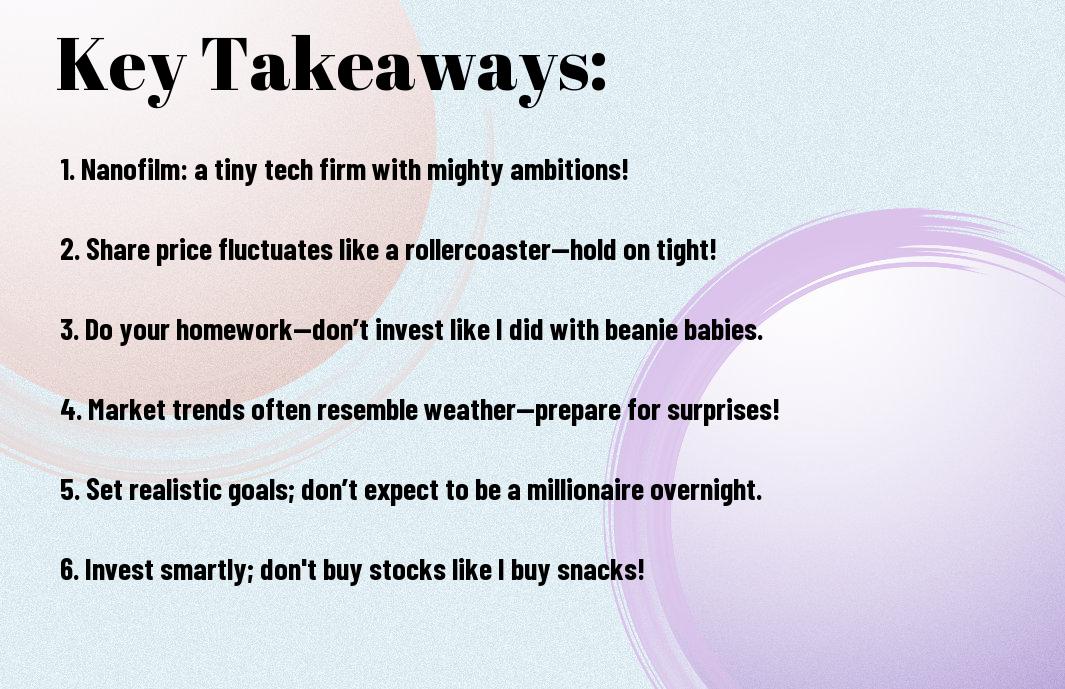

Key Takeaways:

- Investing in Nanofilm Technologies (MZH.SI) can be a rollercoaster ride, akin to chasing a bus—just when you think you’ve got it figured out, it leaves you behind. My experience has taught me to closely monitor the stock price fluctuations, which can be more volatile than a weekend party at a friend’s flat!

- Evaluate the company’s performance through its earnings reports. The last report I pored over had more ups and downs than a toddler on a seesaw, but spotting the trends feels like finding the last slice of pizza at a party—incredibly satisfying!

- Stay updated with the latest news surrounding Nanofilm. Once, I overlooked this and experienced a sudden shift in the market, which felt even more unsettling than losing my wallet after a night out. You might just find the news could save you a few quid!

- Consider diversifying your portfolio. Investing solely in one stock is akin to placing all your trust in a clumsy friend—it’s likely to result in a messy surprise! A balanced approach saved me from some close calls with less resilient stocks.

- Don’t be afraid to learn from your mistakes. I’ve made a number of questionable investments that have left me scratching my head in disbelief, but at least now I have some amusing stories to cheer up my friends at the pub!

The Rollercoaster Ride of Nanofilm Share Prices

A wild ride is the least I can say about my journey with Nanofilm Technologies’ share prices. One minute, I’m on Cloud Nine with soaring prices, and the next, it feels like I’m plummeting to the depths of despair. I’ve seen what was once a promising investment turn into a nail-biting saga—perfect for any financial drama series, really!

The Thrills and Spills: My First Investment

By diving headfirst into my first investment with Nanofilm, I felt like a stock market sorcerer. I was ecstatic when I bought shares on what appeared to be the brink of a bullish trend. Alas, my glee was short-lived as I soon realised that holding shares was more like holding onto a rollercoaster safety bar—full of unexpected twists and turns!

Price Dips and Script Flips: A Comedy of Errors

One day, I was fending off compliments for my “genius” investment strategy, and the next, I was facepalming harder than a sitcom character. You see, I thought I’d be clever, buying more shares when the price dipped—it felt like a smart move! But let’s just say my timing turned out to be as terrible as my second attempt at baking a soufflé.

Thrills and spills became my new investment mantra. The dips felt like slapstick sketches, waking up to see my shares had leapt up one day, only to tumble down faster than my self-confidence after my baking mishap. I soon learnt that investing isn’t just about numbers; it’s about the stories you end up accumulating, often laced with humour and a fair amount of eye-rolling!

The Research Game: What I’ve Learned

The beauty of investing lies in research; I’ve learnt that the more you dig, the more gold you uncover. It’s like a treasure hunt but instead of pirates, you have analysts and financial reports. You might feel a bit lost at times; trust me, I’ve certainly felt the same! However, when you finally find success—or, in my case, a lucrative investment—it brings such joy that you can dance in your living room, even if you’re still in your pyjamas!

Charting Your Way to Success

One of the gems I discovered in my investing journey is chart analysis. It felt daunting at first, like trying to decipher hieroglyphics while juggling. However, once you get the hang of it, these charts can be your best mates. I’ve spotted some promising trends in Nanofilm’s share price movement that made me cheer, possibly alarming my cat in the process!

Analysing the Analysts: Are They Always Right?

Below the surface of the stock market, I’ve found a curious phenomenon: analysts! They offer advice and forecasts, but I’ve learnt they’re not infallible. Their predictions can sometimes resemble a particularly optimistic horoscope—interesting, but not always accurate.

In interpreting all the predictions, I’ve observed that some analysts accurately predict, while others completely fail to do so. It’s like asking two different friends for dinner suggestions—their tastes may vary drastically! Therefore, I’ve learnt to evaluate their advice cautiously and rely on my own intuition. Being well-informed is great, but ultimately, I’m the captain of my own investment ship, and I’ve got to steer it through both calm seas and the occasional storm!

Tips for the Everyday Investor

Once again, I find myself in the world of investing, navigating the choppy waters of stocks like Nanofilm. Here are some tips that have helped me along the way:

- Do your homework before diving in.

- Set a budget and stick to it—don’t go all in like a kid in a sweet shop!

- Keep an eye on market trends, but don’t obsess.

- Consult with friends who know their stuff—a second opinion can save your sanity.

Assume that these tips will steer you in the right direction!

Diversification: Share the Love, Share the Risk

After dabbling in a few stocks, I learnt the value of diversification. Diversification is akin to not placing all your financial resources in a single asset or, even worse, an unstable asset. By diversifying my investments across various sectors, I’ve come to understand that a stock’s decline doesn’t significantly impact my entire portfolio. Think of it as mixing fruit in a cocktail: a little bit of everything to make a lovely drink!

Patience is a Virtue (and a Good Investment Strategy)

Between you and me, waiting for your investments to grow can be as painful as watching paint dry. However, it’s important to remember that patience often pays off in the stock market. I’ve learnt to resist the urge to sell at the first sign of a downturn because, as they say, what goes down must eventually come up again!

Virtue, it seems, is not just about being moral; it’s about being wise with your investments too! I’ve watched stocks fluctuate like a yo-yo, but with a little patience, I’ve seen my investments blossom over time. Don’t fret over every dip; it’s the long-term growth that counts. Stay steady, and you might just find yourself applauding your excellent investment choices in the long run!

The Importance of Staying Informed

Not keeping up with market news can feel a bit like wearing mismatched socks to a job interview—you might just be missing something important! Staying informed is key to smart investing. Every morning, I brew my coffee and check the latest updates, and trust me, those five minutes could save you a fortune. Whether it’s a new breakthrough in technology or a market sentiment shift, being in the loop helps you make decisions that could outweigh the competition and, honestly, save you from those awkward missteps!

Latest News and Updates: Don’t Be the Last to Know!

The world of investing moves at lightning speed, and being the last to know feels like playing a game of catch-up on a treadmill—exhausting and often pointless. I make it a point to follow reliable financial news sources and subscribe to updates about companies I’m interested in, like Nanofilm Technologies. Just last week, I discovered a promising partnership they announced, and it made a noticeable difference in their share price. Talk about a win!

Following Trends Without Falling for Fads

Throughout my investment journey, I’ve discovered the delicate distinction between a trend and a fad—the former can lead to significant opportunities, while the latter can result in a portfolio that resembles a collection of unfashionable haircuts. That’s why I take my time assessing what’s in vogue. Trends, especially in technology stocks like Nanofilm, can provide substantial gains, but it’s crucial to discern whether it’s genuine growth or just a temporary infatuation.

Further, I often probe deep into market analysis and try to spot what’s truly viable. For instance, when Nanofilm began gaining traction due to its innovative coatings, I took the time to investigate their long-term potential. By avoiding the latest ‘hot stock’ that everyone was raving about on social media, I managed to save myself from losses a few friends faced. It’s all about applying common sense and a bit of research so you can enjoy the ups without getting tangled in the fads that fizzle out faster than a deflated balloon!

Real-Life Examples that Made Me Go “Wow!”

Now, investing can be quite the rollercoaster ride, can’t it? One moment, you’re feeling on top of the world, and the next, your nerves are through the roof! I distinctly recall the first time I saw a stock I invested in shoot up by over 50% in a week. My phone almost did a little dance; I shouted so loud, I scared the cat! Little did I know that was just the start of many ‘wow’ moments to come.

The Day I Almost Sold… and Didn’t!

That was a day I’ll never forget! I was staring at Nanofilm’s stock price, completely tempted to sell, as it had almost peaked. I had visions of raiding a local bakery for a mountain of pastries and treating myself. But my gut told me to hold on, and just like that, I avoided a potentially disastrous decision—thank goodness for the love of baked goods distracting me!

When Holding On Paid Off: A Personal Story

Behind every great investor is a story of patience, and mine is no exception. I was once experiencing that dreaded feeling of doubt as I watched my shares of Nanofilm wilt under market pressure. Everyone around me was selling, but I decided to stand firm. It was like I was in a game of chicken, and I refused to blink. A few months later, the stock rebounded spectacularly, leaving my doubts in the dust.

I discovered that my intuition about the company was accurate, as their innovations continued to progress. My faith was rewarded, and those pastries I resisted buying with the cash? Let’s just say they tasted even sweeter after I watched my portfolio blossom! I genuinely learnt that sometimes the best course of action is to simply hold on and enjoy the journey. Now, I tackle every challenge with a touch of humour and an abundance of patience!

The Humorous Side of Investing

Unlike most people, I find investing can sometimes feel like a game of poker with my wallet, where I’m all in but still not quite sure if that was a good idea. You might just end up with a cringe-worthy stock pick that reminds you of that time you thought a banana peel would make a solid investment—only to realise it was simply a slippery slope!

My Greatest Investment Blunders

At various points in my investing journey, I’ve made more than a few blunders that could make a seasoned investor weep. One time, I invested in a tech company based purely on a hunch, only to discover that their “innovative” product was just a fancy paperclip. I think I still have the stock certificate filed away in a drawer… next to the paperclips!

Laughing Through the Losses: Finding the Silver Lining

Investment losses can sting, but I’ve learnt to embrace them with a sense of humour. Rather than grieving over my diminishing portfolio, I now organise a small celebration each time I sell a losing investment. I call it my “bad investment debriefing party”, where I eat ice cream and remind myself that at least I didn’t buy more shares of that awful paperclip company!

Another takeaway from these experiences is that every blunder paves the way for a learning opportunity. Armed with a sprinkle of laughter, I approach each failure with a newfound determination to avoid repeating my mistakes—while still keeping an eye out for the next risky venture that might just pay off handsomely! After all, if I can’t laugh at my setbacks, what’s the point of investing in my own financial comedy show?

Summing up

The journey with Nanofilm Technologies has been quite the rollercoaster, hasn’t it? I still chuckle when I think about my first investment; I bought in during a trading frenzy, only to watch it dip like a badly made soufflé! However, by keeping my nerves steady and doing my research, I found moments to add more to my position at lower prices. It’s all about timing, patience, and perhaps a dash of luck. So, if you’re plunging into Nanofilm, just check your stock quotes regularly and keep your sense of humour intact—it’s half the fun!

FAQ

Q: What is Nanofilm Technologies International Limited and why should I invest in it?

A: Ah, Nanofilm! It’s like that quirky friend who seems a bit out there but ends up being the life of the party. Nanofilm Technologies is a leader in manufacturing advanced nanostructured materials; think of it as the fairy godmother of technology with a wand that does wonders in various industries. My first dabble with shares was when I decided to invest a small amount in Nanofilm after reading an enlightening article. I tracked their share price, and upon witnessing a rise, I excitedly told my friend about it, only for them to suggest I should probably invest in something more exciting. Spoiler alert: Nanofilm turned out to be a smart choice!

Q: How do I find the latest stock quote for Nanofilm?

A: Finding the latest stock quote is easier than finding your lost sock in the laundry! You can check financial news websites, investment platforms, or even good old Google. I once tried to impress a date by discussing stock quotes in a fun café, only to realise that they were far more interested in cupcake flavours. So, unless your date is a stock enthusiast, maybe save the financial talks for later!

Q: What historical events should I know regarding Nanofilm’s stock performance?

A: Ah, the history of Nanofilm is as colourful as my Aunt Mildred’s collection of hats. Over the years, they’ve experienced ups and downs—typical for any stock. A notable event was their initial public offering (IPO) back in 2020 when many investors were getting their feet wet, and subsequently, the stock surged (not unlike a puppy seeing its first snow). I can remember sticking with it during some dip days, thinking, “How low can it go?” Spoiler: it went back up, and now I just chuckle at my previous worries!

Q: What tips do you have for smart investing in Nanofilm?

A: Ah, investing tips! Always have a strategy: do your research, set a budget, and avoid the urge to panic sell—unless, of course, you’re trying to fund an unexpected trip to the Maldives! Give yourself some leeway, as investing isn’t as immediate as ordering a takeaway. I attempted to time the market once—spoiler alert, it felt like trying to catch a bus that vanished into thin air. Instead, pride yourself on a long-term perspective. Great wonders often come with a bit of patience!

Q: Any funny stories related to your investing journey with Nanofilm?

A: Absolutely! There was this one time I was giving my family an investment update over Sunday dinner. I got a bit animated discussing the share price, gesturing enthusiastically only for my mashed potato to fly off my fork and land on my cousin’s shirt. Let’s just say investing has its messy moments! Despite the mishap, my family was intrigued, and now they affectionately call me ‘the stock whisperer’—not sure it’s a title worthy of a medal, but it certainly gave everyone a good laugh!