Finding Your Nearest POSB ATM

While banking might sometimes feel overwhelming, finding a POSB ATM near you is quite straightforward. With the convenience of technology, locating your nearest ATM has never been easier, ensuring you have access to your funds whenever you need them. This is particularly helpful for busy individuals who require quick banking solutions without the hassle of searching for a branch.

Using the POSB Branch and ATM Locator

Locator tools are designed to assist you in efficiently finding the nearest POSB ATM or branch. All you need to do is access the POSB website or mobile app and navigate to the ATM locator feature. Enter your location, and the tool will display a list of ATMs and branches in your vicinity, along with their operating hours.

Understanding the Benefits of Locating ATMs

POSB ATMs offer a variety of services that make banking much more convenient for you. By locating an ATM nearby, you can save time and reduce travel expenses when withdrawing cash. Furthermore, knowing the locations of cash deposit facilities can help streamline your banking processes, especially if you frequently need to deposit money.

Another advantage of locating ATMs is that it allows you to plan your trips efficiently. By knowing where the closest ATMs are, you can combine your banking needs with errands or other activities in your day, ensuring that you make the most of your time.

Tips for Choosing the Most Convenient Location

Some factors to consider when selecting which POSB ATM to visit include operating hours, accessibility, and amenities nearby. Opt for an ATM that fits well within your routine, as this will make your banking experience much easier. Always check the location’s safety and ensure that it’s situated in a well-lit area, especially if you are planning to visit during off-peak hours.

- Consider using an ATM located in popular establishments such as shopping malls.

- Look for ATMs with extended hours to accommodate your schedule.

Please keep in mind the importance of convenience. Choosing your next POSB ATM should be a straightforward process, so aim for the machine that best aligns with your lifestyle and activities.

- Determine if the ATM is conveniently located near your home or workplace.

- Take note of ATMs that offer additional services to lessen your banking load.

Choosing wisely can enhance your banking efficiency, ensuring that each visit to an ATM fits seamlessly into your day. Perceiving your options can lead to a smoother experience in your financial matters.

Key Takeaways:

- POSB ATM Locator: Easily find your nearest POSB branch and ATM in Singapore for seamless banking access.

- Cash Deposit Services: Use the Cash Deposit feature available at select ATMs to conveniently deposit cash.

- ATM Card Usage: To make transactions, insert your ATM, debit, or credit card into the machine.

- Secure Access: Enter your 6-Digit Card PIN for secure access to your account and transactions.

- Efficient Banking: Utilising the POSB services enhances your banking experience by providing quick access to imperative functions.

How to Deposit Cash at POSB ATMs

Any time you need to deposit cash, POSB ATMs provide a convenient option. With just a few simple steps, you can easily add funds to your account without the need to visit a branch. This is particularly beneficial when you’re on the go and wish to avoid queues at the bank. All you need is your ATM, debit, or credit card, and you’re ready to get started!

Step-by-Step Guide to Cash Deposits

Assuming you’ve located the nearest POSB ATM, you will need to follow these steps to complete your cash deposit:

| Step | Action |

| 1 | Insert your ATM, debit, or credit card into the machine. |

| 2 | Key in your 6-digit card PIN to access the menu. |

| 3 | Select the ‘Cash Deposit’ option from the menu. |

| 4 | Insert the cash you wish to deposit in the designated slot. |

| 5 | Confirm the amount and complete the transaction. |

After your transaction is complete, always ensure that you take your card and the receipt if you’ve requested one. This way, you have a record of your deposit along with any necessary confirmation.

Common Mistakes to Avoid During Deposit

Any time you’re using the ATM for cash deposits, there are a few common pitfalls you’ll want to avoid to ensure a smooth experience. One of the most frequent mistakes is not checking that the cash is folded neatly and not too worn out. Bills that are crumpled or damaged may not be accepted by the ATM, causing frustration.

Common errors also include forgetting to double-check the amount you’re depositing on-screen before confirming. It’s easy to miscount, especially if you’re in a rush. To avoid this, take your time and ensure everything appears correct before finalising the transaction.

Tips for a Smooth Transaction

One way to ensure a smooth cash deposit is to prepare ahead of time. Gather your notes and ensure they are free from creases or damages before you reach the ATM. By doing this, you’ll minimise the chances of the machine rejecting your notes. Here are a few handy tips:

- Deposit during off-peak hours to avoid waiting.

- Monitor your surroundings to ensure your safety.

- Use clean, unmarked notes for the deposit.

After following these steps, you’ll find the cash deposit process at POSB ATMs to be efficient and hassle-free.

Step-by-step, it’s important to approach the ATM with a calm mindset. By ensuring you have the correct card and knowing the amount you wish to deposit prior to your visit, you can significantly streamline the process. Here are a few additional tips:

- Familiarise yourself with the ATM interface.

- Always keep your ATM card and PIN secure at all times.

- Don’t hesitate to ask for assistance if needed.

After implementing these strategies, you’re bound to have a great experience during your cash deposit journey!

How to Use Your ATM/Debit/Credit Card

After locating your nearby POSB ATM, you’ll need to know how to properly use your card for a smooth transaction. It’s quite straightforward, and with a bit of practice, you will find the process simple and efficient. Let’s break down the steps to ensure you’re using your card correctly.

Inserting Your Card Correctly

Assuming you’ve found the ATM, the first step is to insert your card. Make sure the card’s magnetic stripe faces towards the machine and is aligned in the right direction, as indicated by the markings on the ATM. Gently push the card into the slot until you feel it firmly in place. If it doesn’t go in easily, double-check the orientation before trying again.

Once your card is inserted correctly, the ATM will usually pull it in and keep it for the duration of the transaction. This simplifies the process for you, as you won’t have to hold on to your card. Just wait patiently for the machine to display the next instructions, and avoid forcing the card if it encounters any resistance.

Keying in Your 6-Digit Card PIN: Tips and Best Practices

Card security is paramount, and one of the vital steps you need to accomplish is keying in your 6-digit PIN. You’ll be prompted to enter this after the ATM has identified your card. To keep your information secure, always cover the keypad with your other hand while typing in your PIN, ensuring no one can see it. It’s also wise never to use easily guessed numbers, such as birthdays or repeated digits.

- Take your time entering your PIN to avoid mistakes.

- If you accidentally input the wrong PIN, do not panic; you can try again after the ATM gives you a moment.

- Your PIN should remain confidential, so avoid disclosing it to anyone.

- You should use a unique PIN for each card.

You should always prioritise card safety when using an ATM. Incorporating these best practices will help you use your card confidently and securely.

- Change your PIN regularly to enhance security.

- Consider setting a reminder for yourself to change it occasionally.

- Take note of your PIN, but ensure you store it securely away from your card.

- You should report any suspicious activity to your bank immediately.

Understanding ATM Interface Prompts

Inserting your card is just the beginning. For a seamless experience, it’s important to understand the interface prompts that the ATM displays after you’ve input your card and PIN. The screen will lead you through the steps required to perform your desired transaction, which could be withdrawing cash, checking your balance, or making deposits. Pay close attention to any instructions, as they will guide you through each process step.

Some ATMs may offer additional options or services, such as language preferences or the ability to print a transaction receipt. Don’t hesitate to explore these features if they are available, as they might enhance your overall experience at the ATM.

Practices like familiarising yourself with the ATM screen layout can help you navigate confidently and efficiently. The more you interact with the machine, the easier it will become to understand its functions and prompts.

Factors to Consider When Using POSB ATMs

Now that you’ve located a POSB ATM near you, it’s important to consider a few factors to ensure a smooth banking experience. Knowing the ATM’s operational hours and safety measures can significantly impact your transaction experience.

ATM Availability and Working Hours

When planning your visit to a POSB ATM, be mindful of its availability and working hours. Most ATMs are operational 24/7; however, some might have limited access due to maintenance or system upgrades. It’s always best to check ahead, especially if you’re planning a late-night withdrawal.

Additionally, certain locations may experience higher footfall, particularly in shopping areas and busy districts. This could lead to longer waiting times during peak hours. By knowing the ATM’s working hours and choosing a quieter time, you can save yourself unnecessary hassle.

Safety Tips While Using ATMs

For your safety, taking precautions while using ATMs is vital. Here are a few tips to keep in mind:

- Always use ATMs in well-lit and populated areas.

- Check for any suspicious devices attached to the card slot before insertion.

- Be aware of your surroundings while conducting transactions.

You should always have your card handy but avoid keeping your PIN and card together for security purposes.

Expanding on the safety tips, it’s wise to be discreet when entering your PIN. Try to shield the keypad from view, as this can deter eager onlookers. Additionally, if you ever feel uncomfortable or notice anything unusual, don’t hesitate to cancel your transaction and move away from the ATM.

- Notify bank representatives immediately if you suspect fraud.

- Always keep a backup of your important numbers, including your bank’s customer service.

Always trust your instincts; if something feels off, it’s better to be cautious than sorry.

What to Do in Case of an ATM Malfunction

Using an ATM can sometimes lead to unexpected malfunctions, like a card being retained or cash not dispensed. If you encounter such issues, it’s vital to act promptly and follow the correct procedures. The first step is to calmly check for any on-screen instructions that may guide you through the process of resolving the problem.

If your card is retained, look for a contact number on the ATM for immediate assistance. It’s typically listed on the screen or nearby. If cash hasn’t been dispensed, check your balance to ensure your account hasn’t been charged. One thing you shouldn’t forget is to wait a few minutes before attempting any next steps, as sometimes the machine needs a moment to reset.

Using the procedure outlined here, you can effectively manage an ATM malfunction without unnecessary stress. Always keep the bank’s contact details handy for quick access, just in case you need to escalate the situation.

Additional Features of POSB ATMs

Not only do POSB ATMs provide a range of services for your banking needs, but they also come equipped with additional features that enhance your banking experience. These functionalities, which range from checking your account balance to printing mini statements, make banking convenient and easily accessible. Let’s explore some of the useful functions POSB ATMs offer.

Checking Account Balance: A Quick How-To

While checking your account balance at a POSB ATM is straightforward, it’s important to ensure you have your ATM, debit, or credit card handy. Simply insert your card into the ATM, and when prompted, enter your 6-digit PIN. Once logged in, select the option to view your balance. You’ll instantly see your available balance displayed on the screen, making it easy for you to assess your funds without needing to visit a branch.

While you’re there, feel free to explore other services as well, like withdrawals or transfers. It’s a quick and efficient way to manage your financial activities without any hassle!

Print Mini Statements: Easy Steps

There’s an important feature of POSB ATMs that allows you to print mini-statements of your recent transactions. This is particularly handy if you need to keep track of your expenditures but haven’t received your latest bank statement yet. To print a mini statement, start by inserting your ATM card and entering your PIN as you would for any transaction.

Once you have access to your account, look for the “print mini statement” option on the screen. After selecting it, the ATM will generate a printed receipt that lists your latest transactions, providing a snapshot of your recent banking activity. This is a great way to stay on top of your financial records!

Understanding the process of printing mini statements is very useful for monitoring your spending habits. Not only does it give you immediate access to your transaction history, but it also helps you keep a physical record if you need one in the future. Make use of this feature to keep your budgeting in check!

Fund Transfers: Interface Navigation Tips

Tips for navigating the fund transfer interface at POSB ATMs can make a big difference in your experience. Once you’ve entered your card information and PIN, you’ll typically find the transfer option on the main menu. From there, select the type of fund transfer you’d like to make, such as transferring within POSB or to another bank. Follow the prompts to enter the recipient’s account details and the amount you wish to transfer.

- Be sure to review the transaction details carefully before confirming.

This ensures you are transferring the right amount to the correct account. Should you require any assistance, the on-screen guides are always there to help you navigate smoothly through the process.

To optimise your fund transfer experience, pay attention to imperative tips for a seamless transaction. Adjust your timings to avoid peak hours when the lines might be longer, and consider checking the ATM for any specific operational instructions it might display. This way, your transactions can be executed quickly and without disturbance!

- By maintaining awareness of your ATM surroundings, you can ensure your transactions are safe and efficient.

Troubleshooting Common ATM Issues

All of us have encountered minor hiccups when using ATMs at some point. While most issues can be easily resolved, it’s always a good idea to know what to do when things don’t go as planned. This section will guide you through common ATM problems, ensuring that your experience remains as smooth as possible.

What to Do If Your Card Gets Stuck

If you find that your card has become lodged in the ATM, don’t panic. The first thing to do is wait a moment; sometimes, the machine may release it automatically. If it doesn’t, it’s best to take note of the ATM location and its identification number, usually found on the machine itself. This information can be helpful when you contact customer support.

After taking note of the details, try to locate a nearby bank branch. Often, a staff member can assist you in retrieving your card if the ATM is owned by the same bank. If not, make sure to report the incident so your card can be deactivated to prevent unauthorised access.

Resolving Transaction Errors: A Quick Guide

Clearly, transaction errors can be frustrating when you’re trying to withdraw or deposit funds. If you see an error message or the transaction fails to complete, the first step is to ensure that there are sufficient funds in your account. If everything seems in order, take note of the error message and the time of the transaction; this information can help resolve the issue more swiftly.

Card readers sometimes experience glitches, so it’s worth waiting a moment and then trying the transaction again. Always ensure you’re using a functional ATM; if the problem persists, it’s advisable to use a different machine or check your card for any visible damage that might hinder its operation.

Contacting Customer Support for Help

Card issues can often arise unexpectedly, so knowing how to contact customer support is handy. If you cannot resolve the problem at the ATM or with nearby staff, don’t hesitate to call your bank’s customer support hotline. They’ll ask for details regarding the issue and can guide you through the next steps needed to rectify it.

Most banks offer 24/7 support, so you don’t have to worry about being left in the dark. Have your card information ready when you call, as it will help expedite the process. Customer support representatives are trained to handle a variety of issues, so you’ll receive the assistance you need to resolve your situation as quickly as possible.

Utilising Cash Deposit Services

Once again, you’ll find that the convenience of technology allows you to deposit cash easily through POSB’s Cash Deposit Services. These services are designed to save you time and provide a seamless banking experience. With locations throughout Singapore, you can quickly deposit your cash without needing to visit a bank teller. Simply locate the closest Cash Deposit Machine, and you’re ready to proceed!

Identifying the Cash Deposit Services Near You

Little effort is required to locate Cash Deposit Services near you. By using the POSB branch and ATM locator, you can easily search for nearby options that offer cash deposit facilities. This feature is particularly helpful for when you are on the move and need to make a quick deposit. Simply input your location or allow the system to access your current position, and you’ll see a list of options at your fingertips.

How to Filter for Cash Deposit Locations

While searching for Cash Deposit locations, it’s important to know how to filter your results effectively. The locator tool allows you to specify what services you need, including cash deposit facilities specifically. By adjusting the filters, you can narrow down your options to find the closest and most convenient machines for your needs.

Locations will vary based on proximity, but using the filter function ensures that you see only those options that suit your requirements. Whether you’re looking for an ATM situated in a mall or a more accessible outdoor location, filtering makes your search straightforward and efficient.

Understanding Deposit Limits and Fees

Filter your understanding of deposit limits and fees, as these can vary based on where you deposit your cash. Each cash deposit machine comes with its own set of rules regarding the maximum amount you can deposit in one transaction and any associated fees that may apply. Being aware of these limits helps you plan your deposits accordingly, ensuring you don’t encounter any surprises at the machine.

This clarity on deposit limits is beneficial for managing your cash flow effectively. Familiarising yourself with these details not only enhances your banking experience but also allows you to make the most of the services offered by POSB. The more informed you are, the better prepared you’ll be when using the Cash Deposit Services.

FAQ

Q: What happens when I arrive at a POSB ATM near me?

A: Upon arriving at a POSB ATM, you will find various services available, including cash withdrawals, balance enquiries, and fund transfers. The ATM will display options on the screen for you to select based on the services you wish to use.

Q: How do I locate the nearest POSB branch or ATM?

A: You can easily locate your nearest POSB branch or ATM by using the POSB branch and ATM locator available on the official POSB website. Simply enter your location details, and it will provide you with the nearest options.

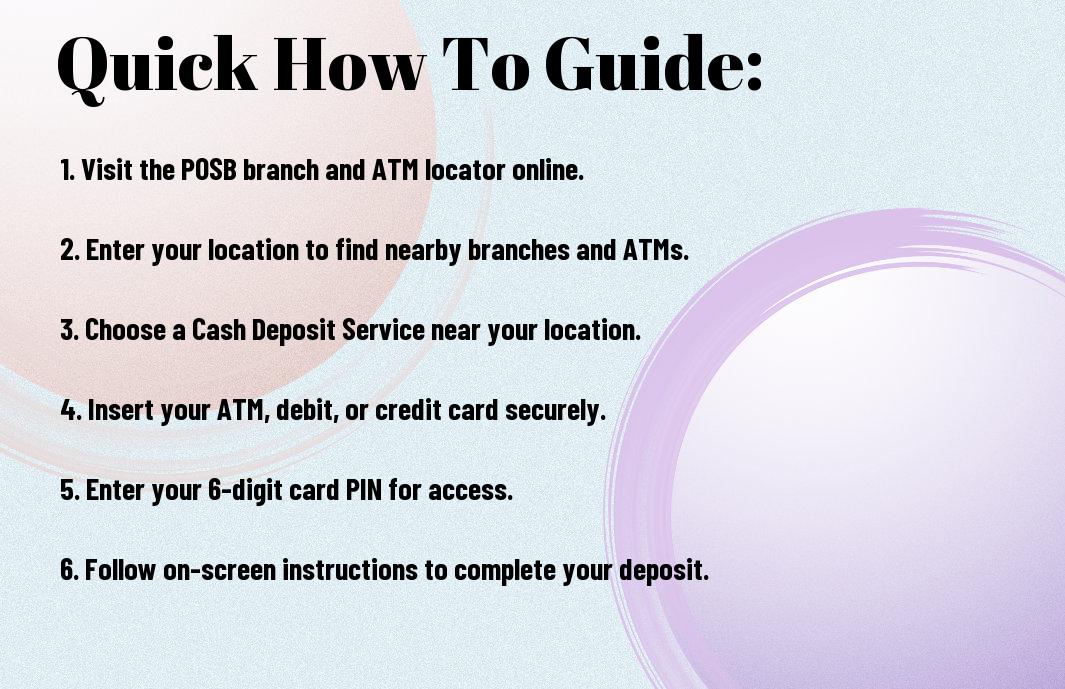

Q: What steps should I follow to deposit cash at a POSB ATM?

A: To deposit cash at a POSB ATM, first locate a Cash Deposit Service ATM. Once there, insert your ATM, debit, or credit card and key in your 6-digit card PIN. Follow the on-screen instructions to insert the cash into the designated slot for your deposit to be processed.

Q: Can I use my POSB ATM card at other bank ATMs?

A: Yes, you can use your POSB ATM card at other bank ATMs, though fees may apply depending on the bank’s policies. Ensure that the ATM displays the relevant logo for compatibility with your card.

Q: What should I do if the ATM does not dispense cash after I complete the withdrawal process?

A: If the ATM does not dispense cash after you have completed the withdrawal, you should first check your account balance to confirm that the transaction was processed. If your account was debited, please report the issue to POSB customer service. They will assist you in resolving the matter and help you retrieve your funds, if necessary.