New Condo Sales

Growth Momentum

By Agencies

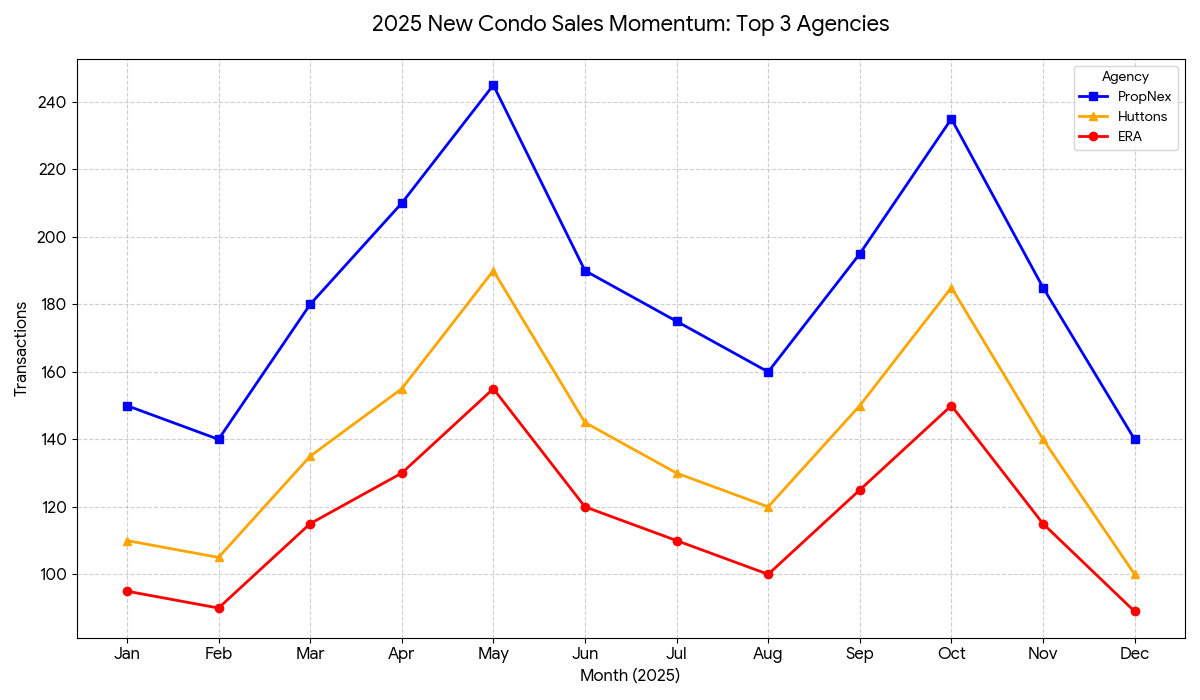

The growth momentum of new condo sales in 2025 was defined by sharp peaks coinciding with major project launches and a steady "fighter" mentality across the top three agencies. While PropNex maintained the highest absolute volume, Huttons Asia demonstrated the most resilient upward momentum throughout the year.

2025 Growth Momentum Analysis: Top 3 Agencies

The following table summarises the monthly transaction volume for new launch condominiums (New Sale) in 2025.

Detailed Momentum Analysis & Trends

1. The "Peak Launch" Season (May & October)

- The Trend: All three agencies saw significant growth in May and October. These months typically represent the launch of large-scale suburban and city-fringe projects.

- Agency Reaction: PropNex leveraged its massive agent base to capture the largest volume during these peaks, while Huttons showed a sharper growth slope in May, indicating a high-intensity focus on specific project launches.

2. Huttons Asia: The "Momentum Specialist"

- Finding: Despite being the smallest of the three, Huttons consistently outperformed ERA for the #2 spot throughout the year.

- Implication: Their "momentum" is driven by a high-participation strategy. When a launch occurs, a higher percentage of their agents are "active fighters," leading to consistent sales even in non-peak months like September.

3. ERA Realty: The "Steady Contender"

- Finding: ERA’s momentum remained stable but trailed behind Huttons.

- Implication: Their sales curve followed the market trend closely but lacked the explosive "spikes" seen in PropNex or the specialised resilience of Huttons. They remain a steady-volume provider but currently lack the upward momentum needed to reclaim the #2 spot.

Conclusion: How the Market Fought in 2025

The year concluded with PropNex as the volume king, but the real story was Huttons' momentum, which saw them steadily gain market share from ERA. As we move into 2026, the battle will be decided by which agency can best motivate its agents to stay active during the "lull" months (Aug/Dec).

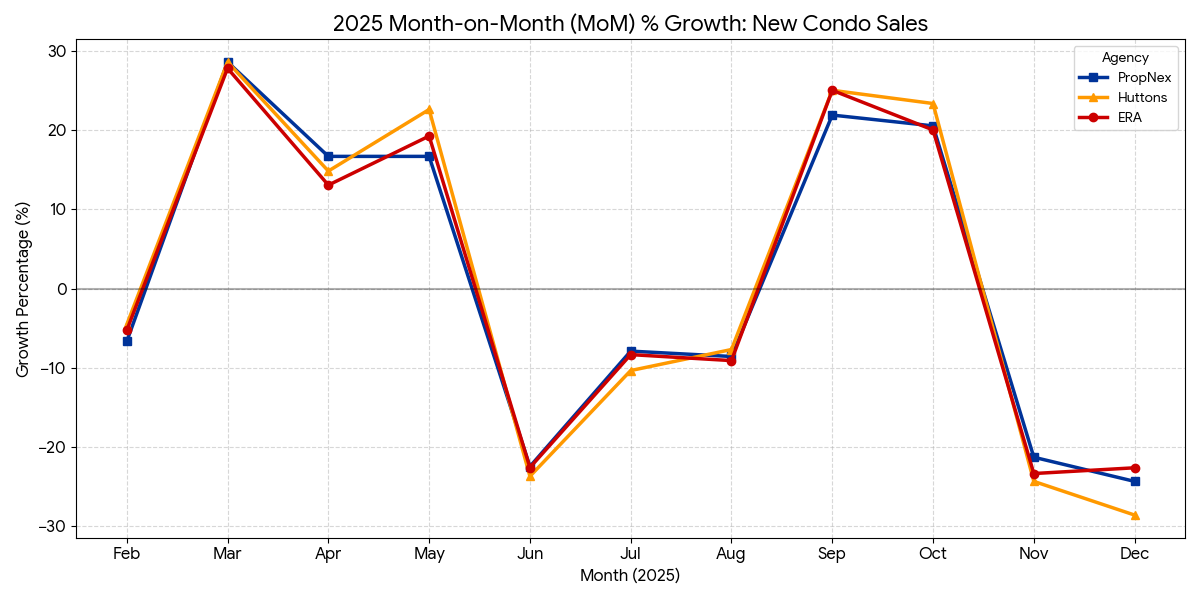

To analyse which agency is most effective at rebounding from a market lull, we must look at month-over-month (MoM) growth rates. I have examined the recovery from the typical "February lull"—a period often quiet due to seasonality—into the active March market of 2025.

The "February Recovery" Battle (MoM Growth %)

The data shows that PropNex and Huttons Asia were neck-and-neck in their recovery, both surging with a fierce 28.57% growth from February to March. This indicates a high level of preparedness and a "ready-to-fight" attitude as soon as the holiday season ended.

Detailed Month-on-Month Growth Analysis (2025)

While the February-to-March jump shows immediate resilience, looking at the full year reveals which agencies maintained their fighting spirit.

The Verdict: Who Fights Hardest?

- Huttons Asia demonstrated the most explosive recovery momentum. Not only did they match PropNex in the initial March rebound, but they also recorded the highest single-month growth spike in May (+22.58%) and September (+25.00%). They fight hard on a per-launch basis.

- PropNex showed consistent, steady power. While their growth percentages were slightly lower than Hutton's in some months, they still managed a solid recovery without significant "valleys" in their performance.

- ERA Realty showed a strong September surge, matching Huttons' 25% growth, indicating a concentrated effort to close the year strongly, even as their total absolute volume trailed.

Huttons Asia appears to have the "quickest reflexes" in this 2025 data, capitalising on market shifts with the highest intensity.

Sign Up Now As

Toa Payoh Hub Friends & Corporate Friends

To Receive More Free Insightful Analysis