Top 20 HDB Resale Agents (2025)

The following list identifies the highest-performing individuals based on residential HDB resale transactions in which they represented either the buyer or the seller.

Agency Performance Analysis: HDB Resale Segment

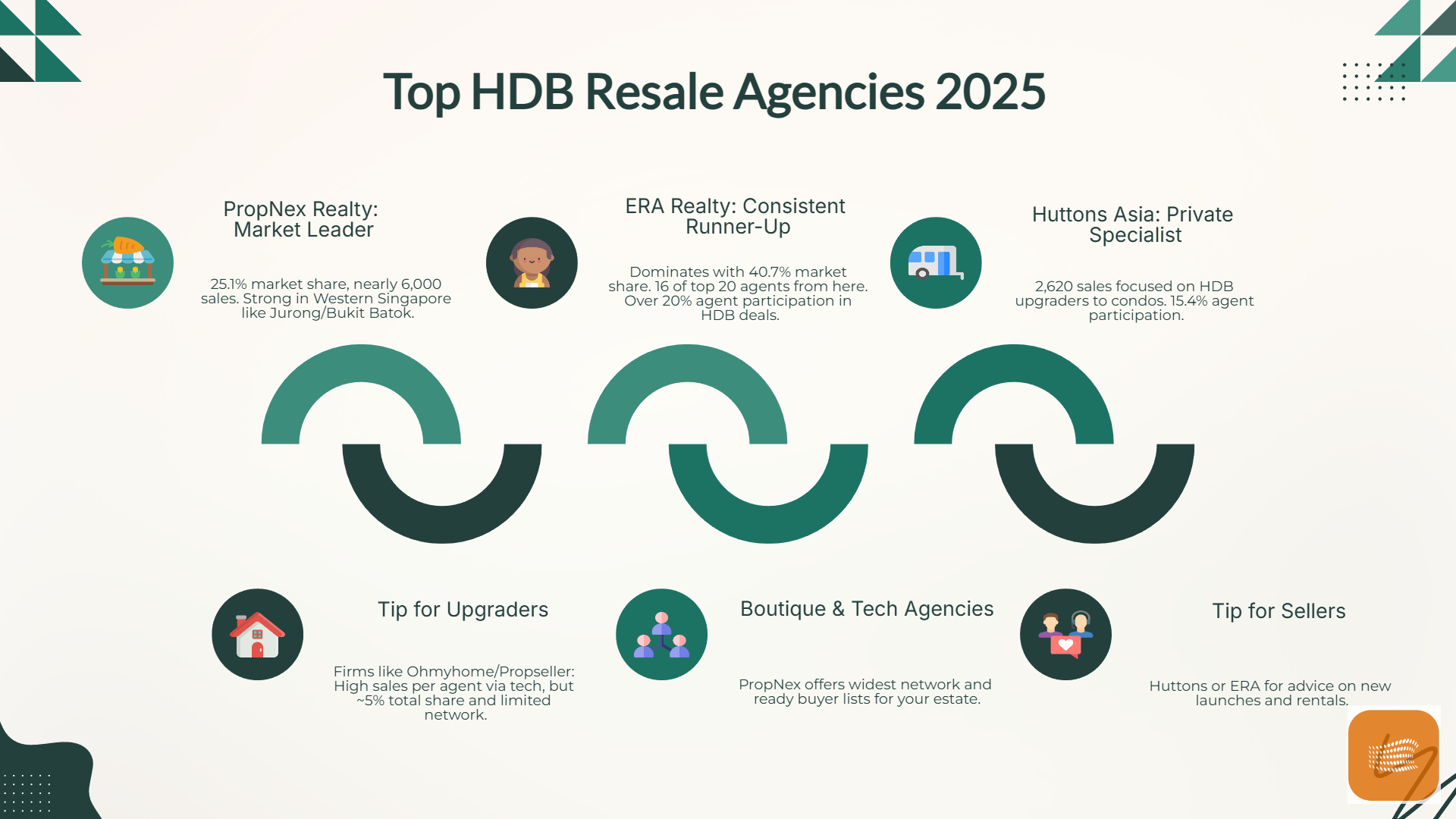

1. PropNex Realty: The Absolute Leader

- Strengths:

- Market Concentration: Held a massive 40.7% market share in 2025.

- Agent Dominance: 16 out of the top 20 agents are from PropNex.

- High Participation: Over 20% of their total agent force successfully closed an HDB deal, the highest among the "Big Three."

- Weaknesses:

- Competition for Leads: With over 2,800 agents active in HDB within the same firm, internal competition for listings in popular towns (like Tampines or Punggol) is exceptionally high.

2. ERA Realty: The Consistent Runner-Up

- Strengths:

- Steady Volume: Maintained a 25.1% share, securing nearly 6,000 sales.

- Regional Strongholds: ERA remains highly competitive in Western Singapore (Jurong/Bukit Batok) and handles a high volume of HDB rental-to-resale transitions.

- Weaknesses:

- Lagging Momentum: Despite being the second-largest agency, they have significantly fewer "super-producers" (agents who close 100+ deals) than PropNex.

3. Huttons Asia: The Private Specialist in HDB

- Strengths:

- Upgrader Focus: Their HDB strategy is heavily tied to their strength in new launches. Many of their 2,620 sales are likely "HDB Upgraders" selling to move into private condos.

- Weaknesses:

- Lowest Participation: Only 15.4% of their agents closed an HDB deal. They are not viewed as a "mass-market" agency by the general public.

4. Boutique & Tech Agencies (SRI / Propseller / Ohmyhome)

- Strengths:

- High Individual Productivity: While their total market share is lower (~5%), agents at firms like Ohmyhome or Propseller often have the highest "sales per agent" ratios because they operate on a high-volume, tech-driven model.

- Weaknesses:

- Limited Reach: Lacks the massive buyer-matching network that PropNex and ERA agents use through internal "co-broking" groups.

Strategic Insight for Consumers

- If Selling: PropNex agents provide the widest network. Their 40% market share means they likely have a "ready buyer" list for your specific estate already in their internal database.

- If Upgrading: Huttons or ERA may offer better-integrated advice if your move involves transitioning into a specific new launch or a rental property, as they specialize in those secondary markets.

For Consumers:

Checklist: How to Choose a Town-Specialist Agent

When interviewing an agent who claims to be a specialist in your area, use this checklist to verify if they have the "Town Momentum" required to sell your flat at a premium price.

Phase 1: The Data Check (Verification)

- [ ] Recent Closings: Have they closed at least 5-10 deals in your specific town/cluster in the last 6 months? (Ask for a CEA transaction history printout.

- [ ] Active Listings: How many active listings do they currently have in your area? (Too many might mean they are spread thin; too few might mean they lack current buyer leads.

- [ ] Price Records: Can they show you a specific instance where they achieved a record-breaking price (or high COV) for a unit similar to yours?

Phase 2: The Strategy Check (Methodology)

- [ ] The "Warm" Buyer List: Do they have a list of buyers who recently missed out on another unit in your block? (This is the fastest way to sell.)

- [ ] Marketing Differentiation: Do they provide professional photography, 3D virtual tours (Matterport), or home staging as part of their standard package?

- [ ] Co-broking Attitude: Are they active in internal agency "Power Groups"? (e.g., PropNex GRP or ERA Swift). A specialist must be willing to co-broke with other agents to find the best buyer quickly.

Phase 3: The "Local" Knowledge Check

- [ ] Upcoming Developments: Can they explain how the Cross Island Line, URA Master Plan, or a new nearby primary school will affect your unit's future valuation?

- [ ] Block-Specific Pros/Cons: Do they know the specific "hidden" issues of your block (e.g., western sun exposure, rubbish chute noise, or lift upgrading status)?

3. Warning Signs: When a "Specialist" Isn't One

- The "Loner" Agent: They work entirely alone without an administrative team or a co-broking network.

- The "Discount" Agent: They offer a significantly lower commission but have no marketing budget for professional videos or portal boosts.

- The "Out-of-Towner": They have high sales volume, but it's scattered across 10 different towns rather than concentrated in yours.

Sign Up Now As

Toa Payoh Hub Friends & Corporate Friends

To Receive More Free Insightful Analysis